Worldline NZ eCommerce APIs

API Endpoint

https://secure.paymarkclick.co.nz/apiIntroduction

This portal describes our eCommerce APIs for CLICK (cards) and Online EFTPOS (OPEN Banking)

We recommend you read this Introduction section in full before looking at specific API details.

The following APIs and services are described in this portal:

- Web Payments API:

-

Create a Hosted Payment Page.

-

Securely tokenise card details for later use.

-

Process a secure transaction from the Merchant’s web site.

-

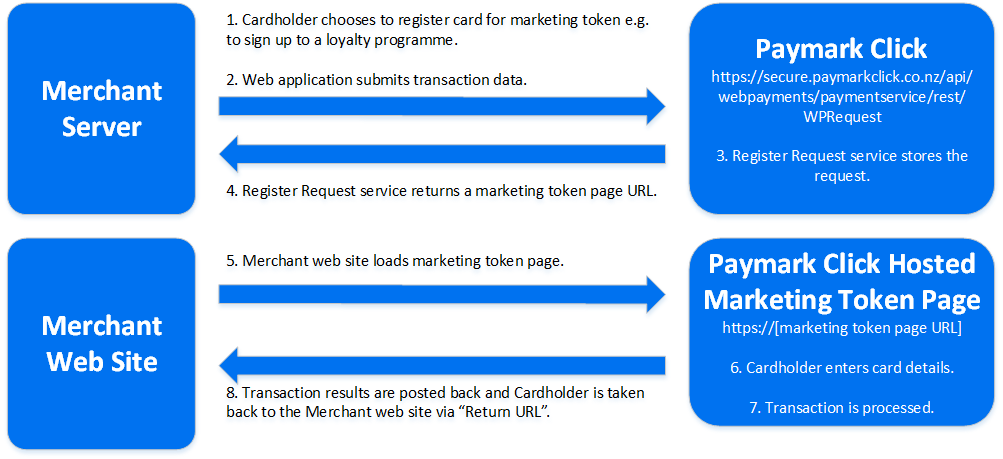

Track payments made on a specific card (marketing token).

2. Transaction Processing API:

-

This set of REST APIs enables Merchant Hosted Payments, as well as “follow up” transactions, such as captures and refunds, against payments and authorisations done through either the Web Payments API or the Transaction Processing API.

-

Merchant Hosted Payments: Process a “two party” card payment, authorisation or status check, or an Online EFTPOS payment.

-

Retrieve transaction details for a payment created through the Web Payments API or the Transaction Processing API.

-

Process a payment or authorisation transaction for a tokenised card (payment token or card token created via the Web Payments API or the Transaction Processing API).

-

Capture a prior authorisation created via the Web Payments API or the Transaction Processing API.

-

Cancel a prior authorisation that is no longer required.

-

Refund a transaction created via the Web Payments API or the Transaction Processing API.

3. [Token Management](#manage-payment-and-card-tokens) API:

-

Retrieve payment token details created via the Web Payments API or the Transaction Processing API.

-

Update card token details, for example, card expiry date.

-

Delete card tokens that are out of date or no longer required.

Sign up for a demo/UAT account here.

You can test Hosted Payment Page in our [Web Payments sandbox](https://demo.paymarkclick.co.nz/guides/app/test/index.html).

End Points

The following end points are available for the Worldline NZ APIs:

Production:

Web Payments: https://secure.paymarkclick.co.nz/api/webpayments/paymentservice/rest/WPRequest

Transaction Processing: https://secure.paymarkclick.co.nz/api/transaction

Retrieve Transaction: https://secure.paymarkclick.co.nz/api/webpayments/paymentservice/rest

Retrieve Payment Tokens: https://secure.paymarkclick.co.nz/api/token/payment

Manage Card Tokens: https://secure.paymarkclick.co.nz/api/token/card

Remove Marketing Token: https://secure.paymarkclick.co.nz/api/token/merchanttoken/

Non-Production:

Web Payments: https://uat.paymarkclick.co.nz/api/webpayments/paymentservice/rest/WPRequest

Transaction Processing: https://uat.paymarkclick.co.nz/api/transaction

Retrieve Transaction: https://uat.paymarkclick.co.nz/api/webpayments/paymentservice/rest

Retrieve Payment Tokens: https://uat.paymarkclick.co.nz/api/token/payment

Manage Card Tokens: https://uat.paymarkclick.co.nz/api/token/card

Remove Marketing Token: https://uat.paymarkclick.co.nz/api/token/merchanttoken/

HTTP Headers

In addition to the headers that are required by the HTTP protocol, Worldline NZ requires that you specify the Content and Accept headers.

The Content header is used to specify the content type that the Merchant application will pass in.

The Accept header is used to specify the content type that your client will accept.

Authentication

Authentication to the Worldline NZ APIs is handled in one of two ways:

-

Passing in the username and password in the request body, or

-

Passing an encoded username and password in the HTTP header.

Refer to the individual APIs for information on what authentication model to use.

Authentication in the Request Body

Authentication is included in the transaction POST, in the username, password and account_id fields.

Example:

username=90127&

password=Paymark123&

account_id=700152Authentication in the HTTP Header

Authentication is achieved by passing an encoded username and password in the HTTP header in the incoming request.

Format: username:password in base64 encoding.

Example:

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| username | Your Worldline NZ Client ID. | Required | String | 50 |

| password | Your Worldline NZ API Password. | Required | String | 50 |

Web Payments ¶

Getting Started

Designed to take web-based card and Online EFTPOS payments by integrating your website or eCommerce platform. The Web Payments API is a RESTful API.

How Web Payments Work

Integration Models

The Web Payments API supports two integration models:

-

Custom Checkout

-

Hosted Payment Page

Select the intergration that best suits your requirements.

All integration models support Online EFTPOS. The Hosted Payment Page also supports Google Pay. Contact Worldline NZ if you wish to enable Online EFTPOS or Google Pay.

3Dsecure is supported under the Hosted Payment Page and Custom Checkout integrations.

Payment methods currently supported include MasterCard, Visa, American Express, and Online Eftpos. Card payments can benefit from 3DSecure more info here as well as Worldline NZ’s merchant-managed fraud tools.

See also Merchant Hosted Transaction Processing. Must be approved by Worldline NZ prior to integrating.

**Custom Checkout**

Custom Checkout is designed to give merchants more control over the payment experience. There’s no need to redirect customers to Worldline’s servers for processing, and as it uses iFrames containing hosted payment fields there is less PCI burden than doing a merchant-hosted API integration.

Custom Checkout is managed by a JavaScript plugin which you can use to create custom payment elements on your website. Worldline NZ handles all of the processing and provides merchants ways to customise the look and feel of the payment elements and the user experience of the payment flow.

**Hosted Payment Page**

This is the most commonly used option. HPP supports card, Online EFTPOS, and Google Pay payments.

With each payment request, an encrypted secure URL is returned to provide a hosted payment page for that transaction. This page contains appropriate merchant and transaction details and the Cardholder/Account Holder is required to enter their card or account information to proceed. Once the Cardholder/Account Holder submits valid card or account details, payment is processed and the transaction results are made available to the Merchant site/service.

As the payment page is hosted by Worldline NZ, it minimises the Merchant’s PCI-DSS compliance requirements.

CSS customisation is supported to enable Merchant branding.

You can sign up for a demo account here. You can try out this integration option in our Web Payments sandbox.

Please talk to your acquiring bank about which integration type and transaction types you are considering. They will assess your site and advise Worldline NZ to enable your preferred option.

Hosted Payment Page ¶

Overview

https://secure.paymarkclick.co.nz/api/webpayments/paymentservice/rest/WPRequest

The Hosted Payment Page service allows your web app to register a payment, authorisation, status check or tokenise request, which will generate a unique URL that the application can use to load a secure payment page.

When setting up the card payment facility with your Acquiring Bank, you need to request the Gateway Hosted integration model. The Bank will then advise of your PCI compliance requirements.

The transactions available are:

-

Payment (purchase) (card, Online EFTPOS and Google Pay)

-

Authorisation (hold funds on a card for future charging)

-

Status check (validates card details with the issuing bank, no funds held or taken)

-

Tokenise card (store card for future payments without validating)

This service is a server to server communication method that validates all data posted to it. The payment request should be sent as a POST web request. All data should be provided in the body of the request formatted as a query string.

Once the request is received, the input will be validated and, if successful, a URL that can be used to access the hosted payment page will be returned. If an error occurs or if invalid data is submitted, a response is provided to the requester in the form of a URL that includes an error code and a description (where applicable).

**Transaction Flow for Hosted Payment Page**

Transaction details may be retrieved by ID or by Merchant reference (Particular or Reference variables).

CSS customisation

The Hosted Payment Page offers a base CSS page that you can download and customise to change the look and feel of the page: https://secure.paymarkclick.co.nz/webpayments/shared/assets/v3/css/base.css.

Once you have updated the CSS, you can upload this for approval via your Merchant Portal (Production portal, Demo portal). We will review the CSS and publish it in that environment. Note: To ensure replication across all Worldline NZ servers, please ensure each version of the CSS file has a different name e.g. include a date or version number in the file name.

Request Data

The following table shows the input fields that can be posted to the Hosted Payment Page API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional. There are two custom fields reference and particular.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| username | Your Worldline NZ Client ID. | Required | String | 50 |

| password | Your Worldline NZ API Password. | Required | String | 50 |

| account_id | Your Worldline NZ Account ID. | Required | Integer | N/A |

| cmd | Defines the Web Payments integration service to use. Always use “_xclick” for a HPP request. | Required | String | N/A |

| amount | The transaction amount in NZD. Must be a positive value (more than zero) for purchase or authorisation requests. Ignored (and may be omitted) for “status check” requests. Ignored (but must be provided) for “tokenise” requests. | Required | Decimal | N/A |

| type | Type of transaction requested, “purchase”, “authorisation” or “statuscheck”. Purchase is used to make a payment. Authorisation validates card details and holds funds on the card. Status check validates card details but does not hold any funds on the card; this is recommended for storing a card for future charges. A fourth option, “tokenise” is also available, however this does not validate card details. | Required | String | N/A |

| reference | Merchant defined value stored with the transaction. For Merchants accepting cards and Online EFTPOS, this should be a 12 character alphanumeric order identifier. This will appear on the Account Holder’s bank statement and is truncated at 12 characters, and any spaces or special characters will be removed. | Optional | String | 50 |

| particular | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| return_url | The URL that the Cardholder/Account Holder will be sent to on completion of the payment. This must be a publicly accessible URL. (see Two Return Options section) to ensure the Customer is returned to the Merchant web site. | Required | String | 1024 |

| display_customer_email | 0 or 1 as to whether to display the customer email receipt field. 0 = hide (default), 1 = display. | Optional | Integer | N/A |

| store_payment_token | Determines if the Customer’s payment method will be stored (tokenised) when the transaction is successful. 0 = do not display option to store payment method (default), 1 = display option to store payment method for future use, 2 = store payment method without asking Customer (Customer must have opted into storing the payment method on the Merchant’s web site). If type is set to “tokenise”, the store_payment_token parameter will be ignored. | Optional | Integer | N/A |

| token_reference | Merchant defined reference associated with the stored payment method (or card token). Allowed: alphanumeric, spaces, special characters @ # ’ " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

In addition, the following fields may be included for card transactions.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| merchant_token | 0 or 1 as to whether a marketing token should be generated and returned upon successful completion of the payment. 0 = do not generate a marketing token (default), 1 = generate and return marketing token. Note: If 1 is used, it is expected the Cardholder has opted in to creating a marketing token elsewhere on the Merchant web site. | Optional | Integer | N/A |

| transaction_source | “MOTO” or “INTERNET” to indicate the source of the transaction. | Optional | String | N/A |

| button_label | Customise the text used on the “MAKE PAYMENT” button. Text will always be displayed in capitals. Allowed: alphanumeric, spaces, special characters $ , - ’ ! ? . # | Optional | String | 20 |

Example:

POST https://secure.paymarkclick.co.nz/api/webpayments/paymentservice/rest/WPRequest HTTP/1.1

Content-Type: application/x-www-form-urlencoded

account_id=700152&

username=90127&

password=Paymark123&

cmd=_xclick&

amount=10.00&

type=purchase&

reference=Reference&

particular=Particular&

display_customer_email=1&

store_payment_token=2&

token_reference=Account 12345&

button_label=PAY AND SAVE CARD

return_url=https%3A%2F%2Fyour-site.com%2FMy-Return-URL%3FRef%3DReference

POST https://secure.paymarkclick.co.nz/api/webpayments/paymentservice/rest/WPRequest HTTP/1.1

Content-Type: application/x-www-form-urlencoded

account_id=700152&

username=90127&

password=Paymark123&

cmd=_xclick&

type=statuscheck&

reference=Reference&

particular=Particular&

display_customer_email=1&

store_payment_token=2&

token_reference=Account 12345&

button_label=SAVE CARD

return_url=https%3A%2F%2Fyour-site.com%2FMy-Return-URL%3FRef%3DReference

Note: Data is passed to the service as a URI query string so if a parameter contains URL punctuation characters it must be URL encoded. For example, reference=Ref?001 and particular=Part&001.

Response Data

Result Options

| Result | Description |

|---|---|

| Success | https://< webpaymentsbaseurl >?q=<hosted payment page id> |

| Failure | Returns REST error information in XML format. See REST Exceptions. |

Example:

<string xmlns="http://schemas.microsoft.com/2003/10/Serialization/">

https://secure.paymarkclick.co.nz/api/webpayments/default.aspx?q=5e274bfe878446a997e252b0c4189cc0

</string>Important

The Hosted Payment Page URL returned will be wrapped in an XML element in string format. You will need to extract the URL and redirect the customer to it. The customer will then enter their payment details directly into the Hosted Payment Page for processing.

Transaction Result

Transaction results, along with a set of other parameters, will be posted back to the Merchant’s return_URL. At the same time, the customer will be redirected back to the required return_URL.

For security and reliability reasons, Merchants are required to retrieve and validate the transaction results using the Retrieve Transaction function and not rely on the return post variables received in the return_URL.

Note:

Your return_url must have a valid SSL certificate to avoid the customer’s browser prompting any security warning messages. The hosted payment page is a secure page. If the web page referenced in the return_url is not secure, most browsers prompt the customer not to continue.

**Output fields for post to return_URL**

The following table shows the output fields to be posted back to the return_URL, along with a brief description of each.

| Name | Description | Type | Length |

|---|---|---|---|

| TransactionId | Worldline NZ defined unique transaction ID. | String | 8 |

| Type | Transaction type (PURCHASE, AUTHORISATION, STATUS_CHECK, OE_PAYMENT, TOKENISE). | String | 50 |

| AccountId | The Worldline NZ Account ID used for processing the transaction. | Integer | 8 |

| Status | Status of the transaction. 0 = UNKNOWN, 1 = SUCCESSFUL, 2 = DECLINED, 3 = BLOCKED, 4 = FAILED, 5 = INPROGRESS, 6 = CANCELLED. | String | 50 |

| TransactionDate | Date and time when the transaction was processed. | Datetime | N/A |

| BatchNumber | Content of this data can vary based on type of transaction. Currently when this contains a value, it is a string representing the “estimated settlement date” of the transaction. | String | 100 |

| ReceiptNumber | Worldline NZ defined unique receipt ID. | Integer | 9 |

| Amount | Amount of transaction in NZD, in the format 1.23. | Decimal | 20 |

| Reference | Reference used for the transaction, as defined by the Merchant. | String | 100 |

| Particular | Particulars used for the transaction, as defined by the Merchant. | String | 100 |

| CardStored | When store_payment_token, store_card or store_card_without_input were used in the request, and the Customer paid using a card, this indicates whether or not the card was stored. false = not stored, true = stored. Will always be false for Online EFTPOS payments, even when store_payment_token has been used in the request. | Boolean | 10 |

| ErrorCode | The error code indicating the type of error that occurred. See Response Codes and Messages for a full listing of error codes. | String | 4 |

| ErrorMessage | The error message explaining what the error means. See Response Codes and Messages for a full listing of error codes. | String | 510 |

| PaymentToken | The token of the newly stored payment method. Only available if the store_payment_token variable was set to 1 or 2, and the Customer chose to store their payment method details, and the transaction was successful. | String | 100 |

| PaymentTokenStatus | The status of the token request. The status is provided regardless of whether the token was created or not, so in the event a token could not be created, this is made clear to the Merchant. SUCCESS = payment token has been created (and PaymentToken will contain the token ID). MERCHANT_NOT_ENABLED = Customer selected a payment method for which the Merchant may not create tokens, for example, Online EFTPOS. USER_DECLINED = May appear when store_payment_token variable was set to 1. Note: If Customer has paid using a card, and Customer has not selected Save Card, CardStored variable shows as false and there is no PaymentToken or PaymentTokenStatus. ERROR = If (transaction) status = DECLINED, this means the Customer declined the Online EFTPOS payment. Or if there is another transaction status, this is an undefined issue when attempting to create the token. PROCESSING = awaiting Customer action for an Online EFTPOS payment. |

String | 100 |

| TokenReference | Merchant defined reference associated with the stored payment method. Present if the Customer paid using a card. | String | 50 |

The following table shows output fields that may also be present for a card payment.

| Name | Description | Type | Length |

|---|---|---|---|

| AuthCode | Authorisation code returned by the Bank for this transaction. | String | 100 |

| CardType | The card type used for this transaction (MASTERCARD, VISA, AMERICAN_EXPRESS). | String | 50 |

| CardNumber | Masked card number showing first 6 and last 4 digits of the card. | String | 100 |

| CardExpiry | Expiry date of the card, in the format MMYY. | String | 100 |

| CardHolder | The Cardholder name entered into the hosted payment page. | String | 100 |

| MerchantToken | The marketing token registered for the card used for this transaction. Only available if the merchant_token variable was set to 1. | String | 100 |

| CardToken | The token of the newly stored payment method, if the Customer paid using a card. Only available if the store_payment_token variable was set to 1 or 2, or store_card / store_card_without_input was set to 1, and the Customer chose to store their payment method details, and the transaction was successful. | String | 100 |

| AcquirerResponseCode | Response code from the acquirer to indicate the status and errors of a particular transaction processed. | String | 6 |

**Note on Transaction Status**

The status field in the transaction response enables you to manage the customer experience in your website. For example:

-

SUCCESSFUL: payment has been processed.

-

DECLINED: the Bank declined the payment.

-

CANCELLED: the customer cancelled the payment.

Merchant Hosted Transaction Processing ¶

Overview

https://secure.paymarkclick.co.nz/api/transaction/

Please contact Worldline NZ before testing this integration type.

The Transaction Processing API allows a Merchant to process a secure card or Online EFTPOS payment from their own web site (\"two party payment\").

With this option, Merchants are able to utilise their own functions and processes to collect and store card details, and then make a direct server to server API call to process transactions via the Transaction Processing API. Merchants also have the option of bulk processing transactions with pre-collected card details. Having the ability to collect and store card details, Merchants are required to meet full PCI-DSS compliance.

If Merchant Hosted Transaction Processing is required, please talk to your Acquiring Bank. The Bank will assess your site and advise Worldline NZ.

Supports Online EFTPOS.

Does not support 3Dsecure.

The Transaction Processing API is a RESTful API over HTTP, with a JSON payload.

Method Options

This API offers the following methods to process transactions:

Purchase with Card Details

This method allows Merchants to make a purchase transaction by passing in card data.

This method also allows this card to be stored (tokenised) and the token and token reference be returned with the transaction result. The next time a transaction is to be done on this card, the token can be used to process the transaction.

**Input Fields**

The following table shows the input fields that can be posted to the Transaction Processing API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| accountId | Worldline NZ issued Account ID. | Required | Integer | N/A |

| amount | The transaction amount in NZD. Must be a positive value. | Required | Decimal | N/A |

| reference | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| particular | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| Email address for the Cardholder. This field is for the Merchant’s use: Click does not send any information to the Cardholder for transactions done through the Merchant Hosted Transaction Processing API. If not required, leave blank. | Optional | String | 50 | |

| cardNumber | Card number without spaces. Numeric format. | Required | String | 12-19 |

| cardType | Card type. Accepted values are: “MC” MasterCard, “VISA” Visa, “AMEX” American Express. | Required | String | N/A |

| cardExpiry | Card expiry date, in the format MMYY. E.g. 0518 for May 2018. Numeric format. | Required | String | 4 |

| cardHolder | Cardholder name that appears on the card. Allowed: alphanumeric, spaces, special characters - ’ | Required | String | 256 |

| cardCSC | Card security code found on the back of the card, in numeric format. If passed it will be used, if left null or blank it will be ignored. Needs to be 4 digits for American Express, 3 digits for all other card types. | Optional | String | 3 or 4 |

| merchantToken | Whether a marketing token should be registered and returned upon successful completion of the payment. 0 = do not register a marketing token (default), 1 = register and return a marketing token. | Optional | Integer | 1 |

| storeCard | Whether the card should be stored and assigned a card token upon successful completion of the payment. 0 = do not store card (default), 1 = store card and return a card token. | Optional | Boolean | N/A |

| tokenReference | Merchant defined reference associated with the stored card token. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , + ? [ ] ( ) - _ | Optional | String | 50 |

| transactionFrequency | Indicates whether this is a single or a recurring transaction. If not passed in or empty, it will take the default frequency from the Worldline NZ account setting. Set to “Single” when charging a saved card, for example, the Customer has previously opted to save their Card then chooses to use this for a later purchase. For a Merchant initiated regular repeat purchase, for example, a magazine subscription, use “Recurring”. Allowed: “Single” or “Recurring” | Required | String | N/A |

| surchargeOverride | If you do not want the pre-configured surcharge to be applied, you can alter the surcharge amount using this field. Setting it to 0 will apply no surcharge. Any positive decimal value provided in this field will be applied. e.g. to surcharge $1, send 1.00 | Optional | Decimal | N/A |

Example:

POST https://secure.paymarkclick.co.nz/api/transaction/purchase/ HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json

{

"accountId":700152,

"amount":10.00,

"reference":"Reference",

"particular":"Particular",

"cardNumber":"4987654321098769",

"cardType":"VISA",

"cardExpiry":"0517",

"cardHolder":"Mr John Smith",

"cardCSC":"111",

"storeCard":1,

"tokenReference":"TokenReference"

}

**Output Fields**

Standard response outputs are detailed in the Outputs section.

Possible Exceptions

| Exception | Description |

|---|---|

| Authorization Exception | Username and password are not correct or the web service is not available to you. |

| Card Details Exception | Card details passed do not pass card validation. |

| One Dollar Auth Exception | Unable to obtain the $1 authorisation from the card details specified (if storing card data). |

For a full list of REST exceptions, refer to the REST Exceptions section.

Authorisation with Card Details

This method allows Merchants to make an authorisation transaction by passing in card data. An authorisation transaction holds funds on the card for charging at a later date, for example, if stock levels need to be checked before an order can be fulfilled. All authorisation transactions need to be either captured (charged) or cancelled (removes the hold).

This method also allows the card to be stored (tokenised) and the token and token reference be returned with the transaction result. The next time a transaction is to be done on this card, the token can be used to process the transaction.

See also:

**Input Fields**

The following table shows the input fields that can be posted to the Transaction Processing API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| accountId | Worldline NZ issued Account ID. | Required | Integer | N/A |

| amount | The transaction amount in NZD. Must be a positive value. | Required | Decimal | N/A |

| reference | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| particular | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| Email address for the Cardholder. This field is for the Merchant’s use: Worldline NZ does not send any information to the Cardholder for transactions done through the Merchant Hosted Transaction Processing API. If not required, leave blank. | Optional | String | 50 | |

| cardNumber | Card number without spaces. Numeric format. | Required | String | 12-19 |

| cardType | Card type. Accepted values are: “MC” MasterCard, “VISA” Visa, “AMEX” American Express. | Required | String | N/A |

| cardExpiry | Card expiry date, in the format MMYY. E.g. 0518 for May 2018. Numeric format. | Required | String | 4 |

| cardHolder | Cardholder name that appears on the card. Allowed: alphanumeric, spaces, special characters ’ - | Required | String | 256 |

| cardCSC | Card security code found on the back of the card, in numeric format. If passed it will be used, else if left null or blank it will be ignored. Needs to be 4 digits for American Express, 3 digits for all other card types. | Optional | String | 3 or 4 |

| merchantToken | Whether a marketing token should be registered and returned upon successful completion of the payment. 0 = do not register a marketing token (default), 1 = register and return a marketing token. | Optional | Integer | 1 |

| storeCard | Whether the card should be stored and assigned a card token upon successful completion of the payment. 0 = do not store card (default), 1 = store card and return a card token. | Optional | Boolean | N/A |

| tokenReference | Merchant defined reference associated with the stored card token. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , | Optional | String | 50 |

| transactionFrequency | Indicates whether the transaction is a single or a recurring transaction. If not passed in or empty, it will take the default frequency from the account setting. Set to “Single” when charging a saved card, for example, the Customer has previously opted to save their Card then chooses to use this for a later purchase. For a Merchant initiated regular repeat purchase, for example, a magazine subscription, use “Recurring”. Allowed: “Single” or “Recurring”. | Required | String | N/A |

| surchargeOverride | If you do not want the pre-configured surcharge to be applied, you can alter the surcharge amount using this field. Setting it to 0 will apply no surcharge. Any positive decimal value provided in this field will be applied. e.g. to surcharge $1, send 1.00 | Optional | Decimal | N/A |

Example:

POST https://secure.paymarkclick.co.nz/api/transaction/authorisation/ HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json

{

"accountId":700152,

"amount":10.00,

"reference":"Reference",

"particular":"Particular",

"cardNumber":"4987654321098769",

"cardType":"VISA",

"cardExpiry":"0517",

"cardHolder":"Mr John Smith",

"cardCSC":"111",

"storeCard":1,

"tokenReference":"TokenReference"

}

**Output Fields**

Standard response outputs are detailed in the Outputs section.

Possible Exceptions

| Exception | Description |

|---|---|

| Authorization Exception | Username and password are not correct or the web service is not available to you. |

| Card Details Exception | Card details passed do not pass card validation. |

| Payment Details Exception | Authorisation transaction details do not pass validation. |

| One Dollar Auth Exception | Unable to obtain the $1 authorisation from the card details specified (if storing card data). |

For a full list of REST exceptions, refer to the REST Exceptions section.

Status Check with Card Details

This method allows Merchants to make a status check transaction by passing in card data. A status check validates the card with the Issuer without the need to hold funds on the card.

The primary use for a status check is to store the card for future transactions. The card is stored (tokenised) and the token and token reference be returned with the transaction result. The next time a transaction is to be done on this card, the token can be used to process the transaction.

See also:

Input Fields

The following table shows the input fields that can be posted to the Transaction Processing API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| accountId | Worldline NZ issued Account ID. | Required | Integer | N/A |

| amount | Ignored (and may be omitted) for status check requests. | Optional | Decimal | N/A |

| reference | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| particular | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| Email address for the Cardholder. This field is for the Merchant’s use: Worldline NZ does not send any information to the Cardholder for transactions done through the Merchant Hosted Transaction Processing API. If not required, leave blank. | Optional | String | 50 | |

| cardNumber | Card number without spaces. Numeric format. | Required | String | 12-19 |

| cardType | Card type. Accepted values are: “MC” MasterCard, “VISA” Visa, “AMEX” American Express. | Required | String | N/A |

| cardExpiry | Card expiry date, in the format MMYY. E.g. 0518 for May 2018. Numeric format. | Required | String | 4 |

| cardHolder | Cardholder name that appears on the card. Allowed: alphanumeric, spaces, special characters ’ - | Required | String | 256 |

| cardCSC | Card security code found on the back of the card, in numeric format. While this is an optional field from the API perspective, the Issuer may need this to process the transaction so should be treated as required. Needs to be 4 digits for American Express, 3 digits for all other card types. | Optional | String | 3 or 4 |

| merchantToken | Whether a marketing token should be registered and returned upon successful completion of the payment. 0 = do not register a marketing token (default), 1 = register and return a marketing token. | Optional | Integer | 1 |

| storeCard | Whether the card should be stored and assigned a card token upon successful completion of the payment. 0 = do not store card (default), 1 = store card and return a card token. | Optional | Boolean | N/A |

| tokenReference | Merchant defined reference associated with the stored card token. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , | Optional | String | 50 |

| transactionFrequency | Indicates whether the transaction is a single or a recurring transaction. If not passed in or empty, it will take the default frequency from the account setting. Set to “Single” when charging a saved card, for example, the Customer has previously opted to save their Card then chooses to use this for a later purchase. For a Merchant initiated regular repeat purchase, for example, a magazine subscription, use “Recurring”. Allowed: “Single” or “Recurring”. | Required | String | N/A |

Example:

POST https://secure.paymarkclick.co.nz/api/transaction/statuscheck/ HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json

{

"accountId":700152,

"reference":"Reference",

"particular":"Particular",

"cardNumber":"4987654321098769",

"cardType":"VISA",

"cardExpiry":"0517",

"cardHolder":"Mr John Smith",

"cardCSC":"111",

"storeCard":1,

"tokenReference":"TokenReference"

}

Output Fields

Standard response outputs are detailed in the Outputs section.

Possible Exceptions

| Exception | Description |

|---|---|

| Authorization Exception | Username and password are not correct or the web service is not available to you. |

| Card Details Exception | Card details passed do not pass card validation. |

| Payment Details Exception | Status check transaction details do not pass validation. |

For a full list of REST exceptions, refer to the REST Exceptions section.

Store Card Details without Issuer Validation

This method allows Merchants to store the card for future payments, without validating card details with the card issuer or holding funds on the card. This method exists for historical purposes and is useful for storing card details if the Merchant’s Acquiring Bank does not support status checks.

The recommended method is now Status Check, which validates card details without holding funds on the card.

A card token and token reference be returned with the transaction result. The next time a transaction is to be done on this card, the token can be used to process the transaction.

See also:

Input Fields

The following table shows the input fields that can be posted to the Transaction Processing API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| cardNumber | Card number without spaces. Numeric format. | Required | String | 12-19 |

| cardType | Card type. Accepted values are: “MC” MasterCard, “VISA” Visa, “AMEX” American Express. | Required | String | N/A |

| cardExpiry | Card expiry date, in the format MMYY. E.g. 0518 for May 2018. Numeric format. | Required | String | 4 |

| cardHolder | Cardholder name that appears on the card. Allowed: alphanumeric, spaces, special characters ’ - | Required | String | 256 |

| tokenReference | Merchant defined reference associated with the stored card token. Allowed: alphanumeric, spaces. | Optional | String | 50 |

Example:

POST https://secure.paymarkclick.co.nz/api/token/card HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json

{

"cardNumber":"4987654321098769",

"cardType":"VISA",

"cardExpiry":"0517",

"cardHolder":"Mr John Smith",

"tokenReference":"TokenReference"

}

Output Fields

The store card details transaction processing method has the response outputs as described below.

Output Fields

| Name | Description | Type |

|---|---|---|

| transactionResult | Details of the transaction. See table below for UDT structure. | UDT |

| Name | Description | Type | Length |

|---|---|---|---|

| cardToken | The token of the newly stored card | String | 100 |

| cardType | The card type used for this transaction. (MASTERCARD, VISA, AMERICAN_EXPRESS). | String | 50 |

| cardNumber | Masked card number showing first 6 and last 4 digits of the card. | String | 100 |

| cardExpiry | Expiry date of the card, in the format MMYY. | String | 100 |

| cardHolder | The Cardholder name entered into the secure payment page. | String | 100 |

| tokenReference | Merchant defined reference associated with the stored card token. | String | 100 |

Possible Exceptions

| Exception | Description |

|---|---|

| Authorization Exception | Username and password are not correct or the web service is not available to you. |

| Card Details Exception | Card details passed do not pass card validation. |

For a full list of REST exceptions, refer to the REST Exceptions section.

Outputs

Most of the transaction processing methods in this section have a standard set of response outputs as described below. Note: The Store Card Details without Issuer Validation method has a subset of response outputs.

Output Fields

| Name | Description | Type |

|---|---|---|

| transactionResult | Details of the transaction. See table below for UDT structure. | UDT |

| Name | Description | Type | Length |

|---|---|---|---|

| transactionId | Click assigned unique transaction ID. | String | 8 |

| originalTransactionId | Used in refund, capture and cancellation transactions. Contains the transaction ID for the related (authorisation or payment) transaction. | String | 8 |

| type | Transaction type (PURCHASE, AUTHORISATION, STATUS_CHECK, OE_PAYMENT). | String | 50 |

| accountId | The Worldline NZ Account ID used for processing the transaction. | Integer | 8 |

| status | Status of the transaction. 0 = UNKNOWN, 1 = SUCCESSFUL, 2 = DECLINED, 3 = BLOCKED, 4 = FAILED, 5 = INPROGRESS, 6 = CANCELLED. | String | 50 |

| transactionDate | Date and time when the transaction was processed. | Datetime | N/A |

| batchNumber | Content of this data can vary based on type of transaction. Currently when this contains a value, it is a string representing the “estimated settlement date” of the transaction. | String | 100 |

| receiptNumber | Worldline NZ defined unique receipt ID. | Integer | 8 |

| authCode | Authorisation code returned by the Bank for this transaction. | String | 100 |

| amount | Amount of transaction in NZD, in the format 1.23. | Decimal | 20 |

| surcharge | Surcharge amount, if a card surcharge has been enabled. | Decimal | 20 |

| reference | Reference used for the transaction, as defined by the Merchant. | String | 100 |

| particular | Particulars used for the transaction, as defined by the Merchant. | String | 100 |

| cardType | The card type used for this transaction. (MASTERCARD, VISA, AMERICAN_EXPRESS). Will be “UNKNOWN” for an Online EFTPOS payment. | String | 50 |

| cardNumber | Masked card number showing first 6 and last 4 digits of the card. Will be empty for an Online EFTPOS payment. | String | 100 |

| cardExpiry | Expiry date of the card, in the format MMYY. Will be empty for an Online EFTPOS payment. | String | 100 |

| cardHolder | The Cardholder name entered into the secure payment page. Will be empty for an Online EFTPOS payment. | String | 100 |

| cardStored | Whether or not the card was stored: 0 = not stored, 1 = stored. Will be false for an Online EFTPOS payment. | Boolean | 10 |

| cardToken | The token of the newly stored card, only available if the cardStored variable was set to 1 and the Cardholder chose to store their card details. Will be NULL for an Online EFTPOS payment. | String | 100 |

| errorCode | The error code indicating the type of error that occurred. See Response Codes and Messages for a full listing of error codes. | String | 4 |

| errorMessage | The error message explaining what the error means. See Response Codes and Messages for a full listing of error codes. | String | 510 |

| acquirerResponseCode | Response code from the acquirer to indicate the status and errors of a particular transaction processed. | String | 6 |

| tokenReference | Merchant defined reference associated with the stored card token. Will be NULL for an Online EFTPOS payment. | String | 100 |

| merchantToken | The marketing token registered with Worldline NZ for the card used for this transaction. Only available if the merchantToken variable was set to 1. Will be empty for an Online EFTPOS payment. | String | 100 |

| payerId | Consumer’s personal identifier for Online EFTPOS payments. Will be NULL for card transactions. | String | 100 |

| payerIdType | Type of payerId that was used. Will be NULL for card transactions. | String | 100 |

| bank | Consumer bank to which the Online EFTPOS payment request was sent. Will be NULL for card transactions. | String | 100 |

3Dsecure ¶

Overview

3Dsecure is a payment card industry standard for authenticating a Cardholder performing an online purchase and is designed to provide greater online transaction security for both the Cardholder and the Merchant. It is marketed as “Mastercard Securecode” and “Verified by Visa” (VbV).

With 3DSecure transactions, a Cardholder may be asked to authenticate during a transaction by entering Cardholder specific information, such as a pre-configured password or one time password. This is authenticated by the Cardholder’s Issuing Bank.

3DSecure also provides a level of chargeback protection for participating Merchants under certain conditions.

Enabling 3DSecure

Please contact your Acquirer Bank for 3DS enrolment. Your Acquirer Bank will complete your enrolment and send Worldline NZ an activation notice with the required information.

Please note, if you use 3DS your website and integration method must support the use of sessions and cookies. For some newer web browsers, this means you may not be able to host the payment page in an iFrame.

3DSecure with Hosted Payment Page

For Hosted Payment Page, Worldline NZ handles the entire flow of the 3DS process and no specific development is required.

Possible Errors and Details

Possible 3DS errors are detailed in error codes 270-272 under Response Codes and Messages.

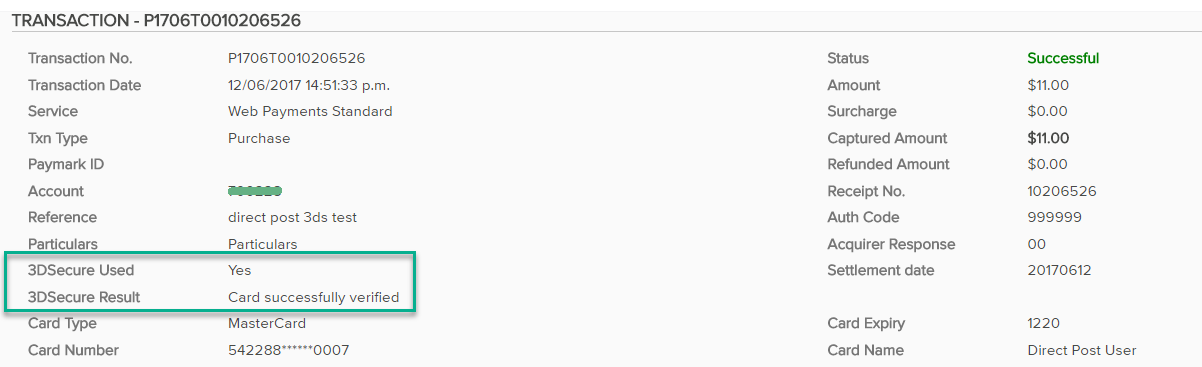

You can see 3DS information for card transactions under “Transactions Details” in the Merchant Portal. You can see whether 3DS was used and what the authentication result was.

Learn more about 3DS here (https://developer.paymark.co.nz/click-3ds2/#top)

Retrieve Transaction ¶

Overview

Once the transaction has been processed the results can be retrieved and validated using one of the methods below. You can retrieve the transaction by transaction ID, reference, or particular.

The Transaction Processing API is a RESTful API over HTTP, with a JSON payload.

Methods

Transaction requests must be sent as a GET request. Input data should be provided as part of the URL request. Once the request is received the input will be validated and, if successful, response will be returned in JSON format with body containing information for the requested transaction.

Authentication is achieved by passing an encoded username and password in the HTTP header (not the body) in the incoming request.

If an error occurs, or if invalid data is submitted, a response is provided to the requester in the form of a URL that includes an error code and a description (where applicable).

Retrieve Transaction by Transaction ID

**Input**

Transaction ID is passed in as part of the URL and no other inputs are required for the request.

Example:

GET https://secure.paymarkclick.co.nz/api/transaction/search/P170310001234567 HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json

**Result Options**

| Result | Description |

|---|---|

| Success | 200 with body containing output elements below. |

| Failure | See exceptions and errors below. |

**Output Fields**

| Name | Description | Type | Length |

|---|---|---|---|

| transactionId | Worldline NZ defined unique transaction ID for this transaction. | String | 8 |

| originalTransactionId | Used in refund, capture and cancellation transactions. Contains the transaction ID for the related (authorisation or payment) transaction. | String | 8 |

| type | Transaction type (PURCHASE, AUTHORISATION, STATUS_CHECK, REFUND, CAPTURE, CANCELLATION, OE_PAYMENT). | String | 50 |

| accountId | Worldline NZ Account ID used for processing the transaction. | Integer | 8 |

| status | Status of the transaction. 0 = UNKNOWN, 1 = SUCCESSFUL, 2 = DECLINED, 3 = BLOCKED, 4 = FAILED, 5 = INPROGRESS, 6 = CANCELLED. | String | 50 |

| transactionDate | Date and time when the transaction was processed. | Datetime | N/A |

| batchNumber | Content of this data can vary based on type of transaction. Currently when this contains a value, it is a string representing the “estimated settlement date” of the transaction. | String | 100 |

| receiptNumber | Worldline NZ defined unique receipt ID. | Integer | 8 |

| authCode | Authorisation code returned by the Bank for this transaction. | String | 100 |

| amount | Amount of transaction in NZD, in the format 1.23. | Decimal | 20 |

| surcharge | If the Merchant has added a surcharge, this is the surcharge amount for this transaction. Note: Contact Worldline NZ to configure a surcharge for your Merchant account. | Decimal | 20 |

| reference | Reference used for the transaction, as defined by the Merchant. | String | 50 |

| particular | Particulars used for the transaction, as defined by the Merchant. | String | 50 |

| cardType | The card type used for this transaction (MASTERCARD, VISA, AMERICAN_EXPRESS). | String | 50 |

| cardNumber | Masked card number showing first 6 and last 4 digits of the card. | String | 100 |

| cardExpiry | Expiry date of the card. Format MMYY. | String | 100 |

| cardHolder | The Cardholder name entered into the hosted web payment page. | String | 100 |

| cardStored | Whether or not the card was stored, false = not stored, true = stored. Always false for Online EFTPOS payments. | Boolean | 10 |

| cardToken | Payment token ID if a payment token was used for this transaction and the payment method associated with this token is a card. | String | 100 |

| errorCode | The error code indicating the type of error that occurred. See Response Codes and Messages for a full listing of error codes. | String | 4 |

| errorMessage | The error message explaining what the error means. See Response Codes and Messages for a full listing of error codes. | String | 510 |

| acquirerResponseCode | Response code from the acquirer to indicate the status and errors of a particular transaction processed. | String | 510 |

| tokenReference | Merchant defined reference associated with the payment token used in this transaction, if the payment method associated with this token is a card. | String | 50 |

| merchantToken | The marketing token registered with Worldline NZ for the card used for this transaction. Only available if the merchantToken variable was set to 1. | String | 100 |

| payerId | Consumer’s personal identifier for Online EFTPOS payments. | String | 100 |

| payerIdType | Type of payerId that was used for Online EFTPOS payments. | String | 100 |

| bank | Consumer bank to which the Online EFTPOS payment request was sent. | String | 100 |

| authenticationReference | Transaction ID for 3DS 2. Can be used as threeDSRequestorInformation.priorAuthenticationInfo.reference in future 3DS 2 transactions for this cardholder. | String | 50 |

**Possible Errors and Exceptions**

| HTTP Response Code | Error Number | Error Message |

|---|---|---|

| 404 Not Found | 5019 | Transaction not found. |

| 401 Unauthorised | 3000 | Authentication error. Username and/or Password are incorrect. |

| 500 Internal Server Error | -1 | Unspecified error, contact Paymark. |

Search for Transactions

Input Fields

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| startDate | Starting date and time of transaction date to be included in the search result, inclusive. Date range cannot be more than 1 year. | Required | Datetime | N/A |

| endDate | Ending date and time of transaction date to be included in the search result, inclusive. Date range cannot be more than 1 year. | Required | Datetime | N/A |

| reference | Reference value which transaction reference should match exactly to be included in the result. | Optional | String | 50 |

| particular | Particular value which transaction reference should match exactly to be included in the result. | Optional | String | 50 |

| clientAccountId | Client Account ID under which transaction should be searched for. If empty, method will search for all transactions under the merchant. | Optional | Integer | N/A |

Example:

GET https://secure.paymarkclick.co.nz/api/transaction/search?

startDate=2017-08-01T00:00:00&

endDate=2017-08-02T00:00:00&

reference=Click-Test-Reference&

particular=Click-Test-Particular&

clientAccountId=7012345

HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json**Result Options**

| Result | Description |

|---|---|

| Success | 200 with body containing up to 100 transactions. For each returned transaction, details are the same as the output fields documented in Retrieve transaction by Transaction ID, ordered by transaction date in descending order. Note if search result covers more than 100 records, only the latest 100 records are returned. Therefore, an appropriate combination of parameters should be considered to restrict the search range. |

| Failure | See exceptions and errors below. |

Possible Errors and Exceptions

| HTTP Response Code | Error Number | Error Message |

|---|---|---|

| 400 Bad Request | 7004 | Start date cannot be greater than End date, please consult the payment web service integration manual. |

| 400 Bad Request | 7005 | Date range greater than 1 year, please restrict the date range, please consult the payment web service integration manual. |

| 400 Bad Request | 7002 | Reference cannot contain more than 50 characters, please consult the payment web service integration manual. |

| 400 Bad Request | 5019 | Particular cannot contain more than 50 characters, please consult the payment web service integration manual. |

| 400 Bad Request | 6023 | Client Account ID provided is not valid. |

| 401 Unauthorised | 3000 | Authentication error. Username and/or Password are incorrect. |

| 500 Internal Server Error | -1 | Unspecified error, contact Worldline NZ. |

Capture Transaction ¶

Overview

The Transaction Processing API allows a Merchant to capture (receive funds for) a previously created successful card authorisation transaction.

The Transaction Processing API is a RESTful API over HTTP, with a JSON payload.

Capture Transaction

Merchants can capture the funds from a successful card authorisation transaction. Will need to pass the authorisation transaction ID and the $amount. This can be less than or equal to, but never more than, the total authorisation transaction amount.

Notes:

-

Authorisations should be finalised through a capture or a cancellation. Otherwise they will expire after roughly 7 days, depending on the card issuer.

-

Cancelled authorisations cannot be captured.

**Input Fields**

The following table shows the input fields that can be posted to the Transaction Processing API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| originalTransactionId | Worldline NZ transaction ID of the authorisation transaction to be captured. Alphanumeric format. | Required | String | N/A |

| amount | The transaction amount in NZD. Must be a positive value. | Required | Decimal | N/A |

| conditionIndicator | Indicates whether this is the last capture to be performed against the authorisation (“final”), or whether additional capture transactions are expected (“partial”). Designed for cases the order is fulfilled in parts, and the customer is charged as each part is fulfilled. | Optional | String | N/A |

| reference | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| particular | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| Email address to send receipt to. If not required, leave blank. | Optional | String | 50 |

Example:

POST https://secure.paymarkclick.co.nz/api/transaction/capture HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json

{

"originalTransactionId":"P160110000014131",

"amount":10.00,

"conditionIndicator":"final",

"reference":"Reference",

"particular":"Particular"

}

**Output Fields**

| Name | Description | Type |

|---|---|---|

| transactionResult | Details of the transaction. See table below for UDT structure. | UDT |

| Name | Description | Type | Length |

|---|---|---|---|

| transactionId | Worldline NZ assigned unique transaction ID. | String | 8 |

| originalTransactionId | Contains the transaction ID of the initial transaction, only populated in a capture, refund or cancellation transaction. | String | 8 |

| type | Transaction type (CAPTURE). | String | 50 |

| accountId | Worldline NZ Account ID used for processing the transaction. | Integer | 8 |

| status | Status of the transaction. 0 = UNKNOWN, 1 = SUCCESSFUL, 2 = DECLINED, 3 = BLOCKED, 4 = FAILED, 5 = INPROGRESS, 6 = CANCELLED. | String | 50 |

| transactionDate | Date and time when the transaction was processed. | Datetime | N/A |

| batchNumber | Content of this data can vary based on type of transaction. Currently when this contains a value, it is a string representing the “estimated settlement date” of the transaction. | String | 100 |

| receiptNumber | Worldline NZ defined unique receipt ID. | Integer | 9 |

| authCode | Authorisation code returned by the Bank for this transaction. | String | 100 |

| surcharge | Surcharge amount, if a card surcharge has been enabled. | Decimal | 20 |

| amount | Amount of transaction in NZD, in the format 1.23. | Decimal | 20 |

| reference | Reference used for the transaction, as defined by the Merchant. | String | 100 |

| particular | Particulars used for the transaction, as defined by the Merchant. | String | 100 |

| cardType | The card type used for this transaction. (MASTERCARD, VISA, AMERICAN_EXPRESS). | String | 50 |

| cardNumber | Masked card number showing first 6 and last 4 digits of the card. | String | 100 |

| cardExpiry | Expiry date of the card, in the format MMYY. | String | 100 |

| cardHolder | The Cardholder name entered into the secure payment page. | String | 100 |

| cardStored | Whether or not the card was stored: 0 = not stored, 1 = stored. | Boolean | 10 |

| cardToken | Payment token ID if a payment token was used for this transaction and the payment method associated with this token is a card. | String | 100 |

| errorCode | The error code indicating the type of error that occurred. See Response Codes and Messages for a full listing of error codes. | String | 4 |

| errorMessage | The error message explaining what the error means. See Response Codes and Messages for a full listing of error codes. | String | 510 |

| acquirerResponseCode | Response code from the acquirer to indicate the status and errors of a particular transaction processed. | String | 6 |

| tokenReference | Merchant defined reference associated with the payment token used in this transaction, if the payment method associated with this token is a card. | String | 100 |

| merchantToken | The marketing token registered for the card used for this transaction. Only available if the merchantToken variable was set to 1. | String | 100 |

| payerId | Not applicable for capture transactions. | String | 100 |

| payerIdType | Not applicable for capture transactions. | String | 100 |

| bank | Not applicable for capture transactions. | String | 100 |

**Possible Exceptions**

| Exception | Description |

|---|---|

| Authorization Exception | Username and password are not correct or the web service is not available to you. |

| Payment Details Exception | Capture transaction details do not pass validation. |

For a full list of REST exceptions, refer to the REST Exceptions section.

Cancellation Transaction ¶

Overview

The Transaction Processing API allows a Merchant to cancel a card authorisation when this authorisation is no longer needed and the funds will never be captured.

The Transaction Processing API is a RESTful API over HTTP, with a JSON payload.

Cancellation Transaction

This method allows Merchants to cancel a previously made, successful, authorisation transaction that is no longer required. All authorisations need to be finalised, either through a Capture or a cancellation. In order to perform a cancellation you will need to pass the original authorisation transaction ID.

Note: If an authorisation has already been captured, it cannot be cancelled.

Input Fields

The following table shows the input fields that can be posted to the Transaction Processing API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| originalTransactionId | Worldline NZ transaction ID of the authorisation transaction to be captured. Alphanumeric format. | Required | String | N/A |

Example:

POST https://secure.paymarkclick.co.nz/api/transaction/cancellation HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json

{

"originalTransactionId":"P160110000014131"

}

**Output Fields**

| Name | Description | Type |

|---|---|---|

| transactionResult | Details of the transaction. See table below for UDT structure. | UDT |

| Name | Description | Type | Length |

|---|---|---|---|

| transactionId | Worldline NZ assigned unique transaction ID. | String | 8 |

| originalTransactionId | Contains the transaction ID of the initial transaction, only populated in a capture, refund or cancellation transaction. | String | 8 |

| type | Transaction type (CANCELLATION). | String | 50 |

| accountID | Worldline NZ Account ID used for processing the transaction. | Integer | 8 |

| status | Status of the transaction. 0 = UNKNOWN, 1 = SUCCESSFUL, 2 = DECLINED, 3 = BLOCKED, 4 = FAILED, 5 = INPROGRESS, 6 = CANCELLED. | String | 50 |

| transactionDate | Date and time when the transaction was processed. | Datetime | N/A |

| batchNumber | Content of this data can vary based on type of transaction. Currently when this contains a value, it is a string representing the “estimated settlement date” of the transaction. | String | 100 |

| receiptNumber | Worldline NZ defined unique receipt ID. | Integer | 9 |

| authCode | Authorisation code returned by the Bank for this transaction. | String | 100 |

| amount | Amount of transaction in NZD, in the format 1.23. | Decimal | 20 |

| reference | Reference used for the transaction, as defined by the Merchant. | String | 100 |

| particular | Particulars used for the transaction, as defined by the Merchant. | String | 100 |

| cardType | The card type used for this transaction. (MASTERCARD, VISA, AMERICAN_EXPRESS). | String | 50 |

| cardNumber | Masked card number showing first 6 and last 4 digits of the card. | String | 100 |

| cardExpiry | Expiry date of the card, in the format MMYY. | String | 100 |

| cardHolder | The Cardholder name entered into the payment page. | String | 100 |

| cardStored | Whether or not the card was stored: 0 = not stored, 1 = stored. | Boolean | 10 |

| cardToken | Payment token ID if a payment token was used for this transaction. | String | 100 |

| errorCode | The error code indicating the type of error that occurred. See Response Codes and Messages for a full listing of error codes. | String | 4 |

| errorMessage | The error message explaining what the error means. See Response Codes and Messages for a full listing of error codes. | String | 510 |

| acquirerResponseCode | Response code from the acquirer to indicate the status and errors of a particular transaction processed. | String | 6 |

| tokenReference | Merchant defined reference associated with the payment token used in this transaction. | String | 100 |

| merchantToken | The marketing token registered with Worldline NZ for the card used for this transaction. Only available if the merchantToken variable was set to 1. | String | 100 |

| payerId | Not applicable for cancellation transactions. | String | 100 |

| payerIdType | Not applicable for cancellation transactions. | String | 100 |

| bank | Not applicable for cancellation transactions. | String | 100 |

**Possible Exceptions**

| Exception | Description |

|---|---|

| Authorization Exception | Username and password are not correct or the web service is not available to you. |

| Payment Details Exception | Cancellation transaction details do not pass validation. |

For a full list of REST exceptions, refer to the REST Exceptions section.

Refund Transaction ¶

Overview

https://secure.paymarkclick.co.nz/api/transaction/

The Transaction Processing API allows a Merchant to refund a previously created successful purchase or capture transaction.

The Transaction Processing API is a RESTful API over HTTP, with a JSON payload.

Refund Transaction

This method allows Merchants to refund a previously made, successful, purchase or capture transaction. In order to perform a refund you will need to pass the original transaction ID and the amount to refund. This can be less than or equal to, but never more than, than the original purchase or capture transaction amount.

Note: You should only attempt to refund a transaction that is less than six months old: there may be issues with the correct Cardholder receiving funds for transactions older than six months.

See also:

**Input Fields**

The following table shows the input fields that can be posted to the Transaction Processing API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| originalTransactionId | The Worldline NZ transaction ID of the transaction to refund. Alphanumeric format. | Required | String | N/A |

| amount | The transaction amount in NZD. Must be a positive value. | Required | Decimal | N/A |

| reference | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| particular | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| Email address to send receipt to. If not required, leave blank. | Optional | String | 50 |

Example:

POST https://secure.paymarkclick.co.nz/api/transaction/refund HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json

{

"originalTransactionId":"P160110000014131",

"amount":10.00,

"reference":"Reference",

"particular":"Particular"

}

**Output Fields**

| Name | Description | Type |

|---|---|---|

| transactionResult | Details of the transaction. See table below for UDT structure. | UDT |

| Name | Description | Type | Length |

|---|---|---|---|

| transactionId | Worldline NZ assigned unique transaction ID. | String | 8 |

| originalTransactionId | Contains the transaction ID of the initial transaction, only populated in a capture, refund or cancellation transaction. | String | 8 |

| type | Transaction type (REFUND). | String | 50 |

| accountId | Worldline NZ Account ID used for processing the transaction. | Integer | 8 |

| status | Status of the transaction. 0 = UNKNOWN, 1 = SUCCESSFUL, 2 = DECLINED, 3 = BLOCKED, 4 = FAILED, 5 = INPROGRESS, 6 = CANCELLED. | String | 50 |

| transactionDate | Date and time when the transaction was processed. | Datetime | N/A |

| batchNumber | Content of this data can vary based on type of transaction. Currently when this contains a value, it is a string representing the “estimated settlement date” of the transaction. | String | 100 |

| receiptNumber | Worldline NZ defined unique receipt ID. | Integer | 8 |

| authCode | Authorisation code returned by the Bank for this transaction. | String | 100 |

| amount | Amount of transaction in NZD, in the format 1.23. | Decimal | 20 |

| surcharge | Surcharge amount, if a card surcharge has been enabled. | Decimal | 20 |

| reference | Reference used for the transaction, as defined by the Merchant. | String | 100 |

| particular | Particulars used for the transaction, as defined by the Merchant. | String | 100 |

| cardType | The card type used for this transaction. (MASTERCARD, VISA, AMERICAN_EXPRESS). | String | 50 |

| cardNumber | Masked card number showing first 6 and last 4 digits of the card. | String | 100 |

| cardExpiry | Expiry date of the card, in the format MMYY. | String | 100 |

| cardHolder | The Cardholder name entered into the secure payment page. | String | 100 |

| cardStored | Whether or not the card was stored: 0 = not stored, 1 = stored. | Boolean | 10 |

| cardToken | Payment token ID if a payment token was used for this transaction and the payment method associated with this token is a card. | String | 100 |

| errorCode | The error code indicating the type of error that occurred. See Response Codes and Messages for a full listing of error codes. | String | 4 |

| errorMessage | The error message explaining what the error means. See Response Codes and Messages for a full listing of error codes. | String | 510 |

| acquirerResponseCode | Response code from the acquirer to indicate the status and errors of a particular transaction processed. | String | 6 |

| tokenReference | Merchant defined reference associated with the payment token used in this transaction, if the payment method associated with this token is a card. | String | 100 |

| merchantToken | The marketing token registered for the card used for this transaction. Only available if the merchantToken variable was set to 1. | String | 100 |

| payerId | Consumer’s personal identifier for Online EFTPOS payments. | String | 100 |

| payerIdType | Type of payerId that was used. | String | 100 |

| bank | Consumer bank to which the Online EFTPOS payment request was sent. | String | 100 |

**Possible Exceptions**

| Exception | Description |

|---|---|

| Authorization Exception | Username and password are not correct or the web service is not available to you. |

| Payment Details Exception | Refund transaction details do not pass validation. |

For a full list of REST exceptions, refer to the REST Exceptions section.

Token Transaction Processing ¶

Overview

The Token Processing API allows a Merchant to use payment tokens to process transactions. A payment token allows Merchants to initiate a payment without requiring the Cardholder to enter any additional information to approve the payment.

This token processing feature can also be built into systems to create an automated, flexible processing system to suit business processes, for example, billing cycles.

This function is implemented by encrypting the payment details via an initial transaction and assigning it a unique token number which can then be used to process future transactions.

For information on managing existing payment or card tokens, see the Manage Tokens section.

The Token Processing API is a RESTful API over HTTP, with a JSON payload.

Method Options

This API offers the following methods to process token transactions:

Purchase with Payment Token

This method allows Merchants to make a purchase transaction using previously stored payment method data. To use this method, the Merchant must have already stored the payment method and have an existing payment token.

Input Fields

The token identifier to be charged is passed in as part of the URL. The following table shows the other input fields that can be posted to the Transaction Processing API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| accountId | Worldline NZ issued Account ID. | Required | Integer | N/A |

| amount | The transaction amount in NZD. Must be a positive value. | Required | Decimal | N/A |

| reference | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| particular | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| Email address to send receipt to. If not required, leave blank. | Optional | String | 50 | |

| transactionFrequency | Card token purchases only. Indicates whether this is a single or a recurring transaction. Set to “Single” when charging a saved card, for example, the Customer has previously opted to save their Card then chooses to use this for a later purchase. For a Merchant initiated regular repeat purchase, for example, a magazine subscription, use “Recurring”. Allowed: “Single”, “Recurring”. | Required | String | N/A |

| transactionSourece | Card token purchases only. Indicates where the transaction request was generated. Set to “Internet” when the cardholder initiates the transaction from a website or app. Set to “MOTO” when the cardholder initiates the transaction over the phone or by giving you card details offline. Set to “Merchant” when the merchant initiates the transaction using stored card details. Allowed: “Internet”, “MOTO” or “Merchant”. | Required | String | N/A |

| agreementId | Card token purchases only. Must be included when transactionFrequency is not “Single”. Identifies an agreement between the cardholder and the merchant, for the merchant to initiate transactions using a specific card on the cardholder’s behalf. | Conditional | String | 50 |

| surchargeOverride | Card token purchases only. If you do not want the pre-configured surcharge to be applied, you can alter the surcharge amount using this field. Setting it to 0 will apply no surcharge. Any positive decimal value provided in this field will be applied. e.g. to surcharge $1, send 1.00 | Optional | Decimal | N/A |

Example:

POST https://secure.paymarkclick.co.nz/api/transaction/purchase/6971410 HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=

Content-Type: application/json

{

"accountId":700152,

"amount":10.00,

"reference":"Reference",

"particular":"Particular",

"transactionFrequency":"Recurring",

"transactionSource":"Merchant",

"agreementId":"123456789"

}

Output Fields

Standard response outputs are detailed in the Outputs section.

Possible Exceptions

| Exception | Description |

|---|---|

| Authorization Exception | Username and password are not correct or the web service is not available to you. |

| Card Token Exception | The card token passed is not found or is invalid. This manifests as a REST exception 400. |

| Payment Details Exception | Payment details do not pass validation. |

For a full list of REST exceptions, refer to the REST Exceptions section.

Authorisation with Payment Token

This method allows Merchants to make an authorisation transaction using previously stored card data. To use this method, the Merchant must have already stored the card with Paymark and have an existing payment (or card) token.

Input Fields

The card token identifier (for the card to be authorised) is passed in as part of the URL. The following table shows the other input fields that can be posted to the Transaction Processing API. A brief description of each field is provided, as well as the accepted data format and whether it is required or optional.

| Name | Description | Required | Type | Length |

|---|---|---|---|---|

| accountId | Worldline NZ issued Account ID. | Required | Integer | N/A |

| amount | The transaction amount in NZD. Must be a positive value. | Required | Decimal | N/A |

| reference | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| particular | Merchant defined value stored with the transaction. Allowed: alphanumeric, spaces, special characters @ # ’ & " ; . \ / ! : , ? [ ] ( ) - _ | Optional | String | 50 |

| Email address to send receipt to. If not required, leave blank. | Optional | String | 50 | |

| transactionFrequency | Indicates whether this is a single or a recurring transaction. Set to “Single” when charging a saved card, for example, the Customer has previously opted to save their Card then chooses to use this for a later purchase. For a Merchant initiated regular repeat purchase, for example, a magazine subscription, use “Recurring”. Allowed: “Single”, “Recurring” or empty string i.e. “”. |

Required | String | N/A |

| surchargeOverride | Card token purchases only. If you do not want the pre-configured surcharge to be applied, you can alter the surcharge amount using this field. Setting it to 0 will apply no surcharge. Any positive decimal value provided in this field will be applied. e.g. to surcharge $1, send 1.00 | Optional | Decimal | N/A |

Example:

POST https://secure.paymarkclick.co.nz/api/transaction/authorisation/6971410 HTTP/1.1

Authorization: Basic dXNlcm5hbWU6cGFzc3dvcmQ=