Linked Gateway API

API Endpoint

https://api.paymark.nz/Overview

Paymark Linked Gateway (LG) is our payment gateway that allows other gateways to connect and settle financial transactions with acquirers and card schemes.

This portal includes the information needed on how to integrate directly with LG APIs. For information on particular features, e.g. credential on file transactions or scheme token transactions, please see our Integration Guide.

LG supports the following transaction types:

-

Payment: charges the Customer’s card immediately and results in funds settled to the Merchant.

-

Refund: returns funds back to a Customer’s card and results in funds returned from the Merchant via the settlement process. Partial and full refunds are supported. Linked and standalone refunds are supported.

-

Status Check: validates Card details that a Customer has provided without reserving funds on the Card.

-

Authorisation: validates Card details that a Customer has provided and reserves funds on the Card for the Merchant. DOES NOT charge the Card and no funds are settled to the Merchant.

-

Capture: charges the Customer’s card using funds reserved from a prior authorisation, and results in funds settled to the Merchant.

-

Cancellation: removes a prior authorisation (and releases reserved funds on the Customer’s card) when these funds are no longer required.

For any assistance with this API specification, please contact Paymark on lgv2@paymark.co.nz.

Connections ¶

Transport

The Linked Gateway API is a RESTful API over HTTP, with a JSON payload.

HTTP Headers

In addition to the headers that are required by the HTTP protocol, Paymark requires that you specify the User Agent, Accept and Authorization headers.

The User Agent header identifies the client software originating the request.

The Accept header is used to specify the content type that your client will accept. Linked Gateway uses application/vnd.paymark_api+json;version=2.0 as its content type. Any other requested content types will result in a 406 Not Acceptable response.

The Authorization header is used to authenticate and authorise requests to Linked Gateway.

Versioning

The Accept header is used to define the requested version of a resource, as defined in the HTTP Headers section.

You should expect that the Linked Gateway API will evolve over time as Paymark adds new features. To ensure compatibility, you must specify the API version with every call you make to the API. At the moment, the latest version is 2.0.

End Points

The base URL for all Linked Gateway 2.0 Production endpoints is https://api.paymark.nz/

The base URL for all Linked Gateway 2.0 pre-Production (Sandbox) endpoints is https://apitest.paymark.nz/

(UAT endpoint deprecated) -> https://lgapi.uat.paymark.nz/

The endpoints available are:

-

/bearer for authenticating and obtaining OAuth 2.0 bearer tokens.

-

/transaction/payment for payments.

-

/transaction/refund for refunds.

-

/transaction/status for status checks.

-

/transaction/authorisation for authorisations.

-

/transaction/capture for captures.

-

/transaction/cancel for cancellations.

-

/transaction/payment-authentication for 3DS authentications.

For example, the full URL for the Production payment endpoint is: https://api.paymark.nz/transaction/payment.

For example, the full URL for the Sandbox payment endpoint is: https://apitest.paymark.nz/transaction/payment.

Errors

The HTTP status code in the response is used to communicate any problems with a request. For example, if the Authorization header were to be omitted then a 401 Unauthorized response would be sent.

Exception Handling

When creating a resource, any non-response or 5xx HTTP errors should be treated as an exception.

Important Note: To ensure financial integrity, you should issue a GET to the appropriate endpoint to see if the transaction was created and its status.

Security

Paymark requires that all connections are encrypted with TLS; there are no unencrypted endpoints available.

Your client must properly validate the TLS trust chain to ensure that your connection to Paymark is secure.

Paymark supports TLS 1.2 only.

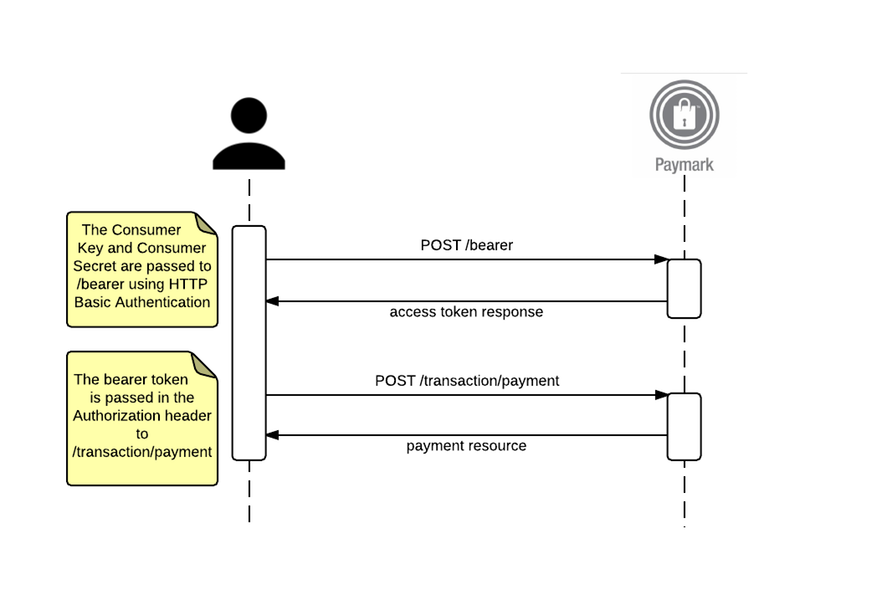

Authentication

Linked Gateway uses the OAuth 2.0 client credentials flow for authentication. You need to register your app to get a Consumer Key and Consumer Secret. You must protect these credentials.

Obtain oAuth Bearer Token ¶

Headers

Content-Type: x-www-form-urlencoded

Authorization: Basic d21lOGNLVzV0eG9MNlp6TXZYZlVRWGlGa0tiSFc1WnE6aWtKNGlpSzhYdVpFMFhVcA==Body

{

"grant_type": "client_credentials"

}Headers

Content-Type: application/vnd.paymark_api+json;version=1.1Body

{

"issued_at": "1614133043705",

"application_name": "896671b5-e6ee-42f8-a33b-df7fa240a54b",

"scope": "",

"status": "approved",

"expires_in": "3599",

"token_type": "BearerToken",

"client_id": "eUU6UB7LeBzyazwzOEmDPajve1Mq4XgR",

"access_token": "qtAGAWgkBL3rxBaVASwID7RC0KCN"

}Obtain oAuth Bearer TokenPOST/bearer

Before calling any Linked Gateway endpoint, you must obtain a Bearer token by issuing a POST to the /bearer endpoint, providing the Consumer Key and Consumer Secret as the username and password respectfully, using HTTP Basic authentication, and passing client_credentials as the grant_type.

The bearer token returned must be provided in the Authorization header of all requests to any other endpoints.

The bearer token has a limited lifetime; you will need to obtain a new token once it has expired.

Payment ¶

Overview

https://api.paymark.nz/transaction/payment

A payment represents a request for a transfer of funds from the Cardholder to the Merchant.

A Merchant must be enabled for payment to send payment requests. Linked Gateway will reject Payment requests if the Merchant has not been enabled for this transaction type by their Acquiring Bank.

| Environment | URL |

|---|---|

| Production | https://api.paymark.nz/transaction/payment |

| Sandbox | https://apitest.paymark.nz/transaction/payment |

Create Payment

Creates a new payment for processing on the Paymark network. The payment will be processed immediately and the returned resource will communicate whether the payment was approved or declined.

PAYMENT REQUEST

POST /transaction/paymentProvide a JSON formatted payment resource as per the examples below.

Example Request - Making an eCommerce Payment with Card Data

POST /transaction/payment HTTP/1.1

Authorization: Bearer uOABwqy14kv010MnLxI4dmb80xlR

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"card":{

"cardNumber":"5123456789012346",

"expiryDate":"2015-07",

"cardSecurityCodePresence":"Present",

"cardSecurityCode":"111"

},

"merchant":{

"cardAcceptorIdCode":"854321",

"transactionReference":"Test Reference",

"transactionInformation":"Test Info",

"timeStamp":"2015-04-14T11:55:04Z"

},

"transaction":{

"amount":5467,

"source":"Web Site",

"storedCredentials":"stored",

"settlementDate":"2015-04-15",

"frequency":"instalment"

}

}

Example Request – 3DS2

POST /transaction/payment HTTP/1.1

Authorization: Bearer uOABwqy14kv010MnLxI4dmb80xlR

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"card":{

"cardNumber":"5123456789012346",

"expiryDate":"2015-07",

"cardSecurityCodePresence":"Present",

"cardSecurityCode":"111"

},

"merchant":{

"cardAcceptorIdCode":"854321",

"transactionReference":"Test Reference",

"transactionInformation":"Test Info",

"timeStamp":"2015-04-14T11:56:04Z"

},

"transaction":{

"amount":5649,

"source":"Web Site"

},

"3ds2": {

"protocolVersion":"2.1.0",

"transactionId":"5646a82d-8b05-40a6-b33e-2038c8670b3a",

"authenticationStatus":"Y",

"eci":"02",

"authenticationStatusReason":"16",

"authenticationValue":"AAABBQHLYDkkad8AImDLAAAAAAA="

}

}

Example Request - Making an eCommerce Payment with Scheme Token Data

IMPORTANT When sending SCHEME_TOKEN transaction type for Customer Initiated Transactions the values provided on the following card object fields are:

| Fields | Value Description |

|---|---|

| cardNumber | scheme token DPAN |

| expiryDate | scheme token expiry date |

| eci | scheme token eci value |

| cryptogram | scheme token cryptogram |

SCHEME TOKEN TRANSACTION REQUEST GUIDE

| Fields | Visa | Mastercard | AMEX |

|---|---|---|---|

| type | Required | Required | Required |

| cryptogram | Required | Required | - |

| eci | Required | Required | Required |

| cardSecurityCode | - | - | Required |

| expiryDate | Required | Required | Required |

POST /transaction/payment HTTP/1.1

Authorization: Bearer uOABwqy14kv010MnLxI4dmb80xlR

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"card":{

"type": "SCHEME_TOKEN",

"cardNumber":"5123456789012346",

"expiryDate":"2015-07",

"eci": "01",

"cryptogram": "AwAAAAAAPboI4MoAmZZRghEAAAA=",

"cardSecurityCodePresence":"Present"

},

"merchant":{

"cardAcceptorIdCode":"854321",

"transactionReference":"Test Reference",

"transactionInformation":"Test Info",

"timeStamp":"2015-04-14T11:55:04Z"

},

"transaction":{

"amount":5467,

"source":"Web Site",

"storedCredentials":"stored",

"settlementDate":"2024-03-05",

"frequency":"single"

}

}

PAYMENT RESPONSE

If successful, returns HTTP 201 Created with the response body containing the full payment resource as per the example below.

Example Response - Making an eCommerce Payment with Card Data

HTTP/1.1 201 Created

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":"https://lgapi.uat.paymark.nz/transaction/payment/

ec2b8e9d-2b88-4460-9257-11d7a629b43b",

"rel": "self"

}

],

"id":"ec2b8e9d-2b88-4460-9257-11d7a629b43b",

"status":"complete",

"creationTime":"2015-04-14T11:55:04.946Z",

"modificationTime":"2015-04-14T11:55:04.946Z",

"card": {

"token":"4ff817be-e6ce-4b66-a797-1a3dce362b3a",

"maskedNumber":"512345..2346",

"expiryDate":"2020-12",

"cardSecurityCodePresence":"Present",

"cardSecurityCodeResponse":"Not Processed"

},

"merchant": {

"cardAcceptorIdCode":"854321",

"transactionReference":"Test Reference",

"transactionInformation":"Test Info",

"street":"123 The Avenue",

"suburb":"Auckland Heights",

"city":"Auckland",

"postalCode":"1000",

"country":"NZ",

"cardAcceptorName":"Mirandas Marvellous Muffins",

"acquiringInstitutionId":"503513",

"mcc":"1234",

"terminal":"98765432101",

"timeStamp":"2015-04-14T11:55:04.946Z"

},

"transaction": {

"amount":5467,

"currency":"NZD",

"source":"Web Site ",

"frequency":"instalment",

"processorResponseCode":"00",

"settlementDate":"2015-04-15",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber":"061610",

"storedCredentials":"stored"

}

}

Example Response - 3DS2

HTTP/1.1 201 Created

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":"https://lgapi.uat.paymark.nz/transaction/payment/7c018008-624b-4436-b393-dc3ad1b22d1e",

"rel": "self"

}

],

"id":"7c018008-624b-4436-b393-dc3ad1b22d1e",

"status":"complete",

"creationTime":"2015-04-14T11:56:04Z",

"modificationTime":"2015-04-14T11:56:04Z",

"card": {

[fields as per previous example]

},

"merchant": {

[fields as per previous example]

},

"transaction": {

"amount":5649,

"currency":"NZD",

"source":"Web Site ",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2015-04-14",

"authorisationCode":"987654",

"retrievalReferenceNumber":"987656789012",

"systemTraceAuditNumber":"061610"

},

"3ds2": {

"protocolVersion":"2.1.0",

"transactionId":"5646a82d-8b05-40a6-b33e-2038c8670b3a",

"authenticationStatus":"Y",

"eci":"02",

"authenticationStatusReason":"16",

"authenticationValue":"AAABBQHLYDkkad8AImDLAAAAAAA=",

}

}

Example Response - Making a Scheme Token Payment

HTTP/1.1 201 Created

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [],

"id": "ec2b8e9d-2b88-4460-9257-11d7a629b43b",

"status": "complete",

"creationTime": "2015-04-14T11:55:04.946Z",

"modificationTime": "2015-04-14T11:55:04.946Z",

"card": {

"maskedNumber": "512345..0008",

"expiryDate": "2025-06",

"cardSecurityCodePresence": "Present",

"cardSecurityCodeResponse": "Not Processed"

"type": "SCHEME_TOKEN"

},

"merchant": {

[fields as per previous example]

},

"transaction": {

"amount": 5649,

"currency": "NZD",

"source": "Web Site",

"frequency": "single",

"processorResponseCode": "00",

"settlementDate": "2015-04-15",

"authorisationCode": "123456",

"retrievalReferenceNumber": "123456789012",

"systemTraceAuditNumber": "061610",

"storedCredentials": "new",

"agreementId": "5b29c055-6e8b-4213-a320-834490f747d8"

}

}

Read Payment

Reads a previously created payment. This does not change the payment in any way.

A payment can be read as soon as it has been created even if processing has not yet completed.

A payment can be read if it was created within the past 2 years. Payments performed more than 2 years ago will be archived by Paymark.

READ PAYMENT REQUEST

To request a single payment resource:

GET /transaction/payment/{id}Example Request - Single Payment

GET /transaction/payment/ec2b8e9d-2b88-4460-9257-11d7a629b43b HTTP/1.1

Authorization: Bearer uOABwqy14kv010MnLxI4dmb80xlR

Accept: application/vnd.paymark_api+json;version=2.0

READ PAYMENT RESPONSE

If successful, returns HTTP 200 OK with the response body containing a payment resource.

Example Response – Single Payment Resource

HTTP/1.1 200 OK

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":"https://lgapi.uat.paymark.nz/transaction/payment/

ec2b8e9d-2b88-4460-9257-11d7a629b43b",

"rel": "self"

}

],

"id":"ec2b8e9d-2b88-4460-9257-11d7a629b43b",

"status":"complete",

"creationTime":"2015-04-14T11:55:04.946Z",

"modificationTime":"2015-04-14T11:55:04.946Z",

"card": {

"token":"4ff817be-e6ce-4b66-a797-1a3dce362b3a",

"maskedNumber":"512345..2346",

"expiryDate":"2020-12",

"cardSecurityCodePresence":"Present",

"cardSecurityCodeResponse":"Not Processed"

},

"merchant": {

"cardAcceptorIdCode":"854321",

"transactionReference":"Test Reference",

"transactionInformation":"Test Info",

"street":"123 The Avenue",

"suburb":"Auckland Heights",

"city":"Auckland",

"postalCode":"1000",

"country":"NZ",

"cardAcceptorName":"Mirandas Marvellous Muffins",

"acquiringInstitutionId":"503513",

"mcc":"1234",

"terminal":"98765432101",

"timeStamp":"2015-04-14T11:55:04.946Z"

},

"transaction": {

"amount":5467,

"currency":"NZD",

"source":"Web Site ",

"frequency":"instalment",

"processorResponseCode":"00",

"settlementDate":"2015-04-15",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber":"061610",

"storedCredentials":"stored"

}

}

Query Payments

Reads a range of previously created payments. This does not change the payments in any way.

A payment can be read as soon as it has been created even if processing has not yet completed.

A payment can be read if it was created within the past 2 years. Payments performed more than 2 years ago will be archived by Paymark.

QUERY PAYMENT REQUEST

| Name | Value | Description |

|---|---|---|

| cardAcceptorIdCode | string | Required. cardAcceptorIdCode field of payment resource. |

| status | string | Status field of payment resource. |

| startTime | date/time, ISO 8601 formatted | Minimum value of creation field of payment resource. |

| endTime | date/time, ISO 8601 formatted | Maximum value of creation field of payment resource. |

| transactionReference | string | Merchant reference for a payment. |

To request a range of payment resources:

GET /transaction/payment?cardAcceptorIdCode={cardAcceptorIdCode}&status={status}&startTime={startTime}&endTime={endTime}Example Request

GET /transaction/payment?cardAcceptorIdCode=854321&transactionReference="Test Reference" HTTP/1.1

Authorization: Bearer uOABwqy14kv010MnLxI4dmb80xlR

Accept: application/vnd.paymark_api+json;version=2.0QUERY PAYMENT RESPONSE

If successful, returns HTTP 200 OK with an array of zero or more payment resources that match the provided query in the response body.

Example Response – Array of Payments

HTTP/1.1 200 OK

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [ {

"href":"https://lgapi.uat.paymark.nz/transaction/payment

?cardAcceptorIdCode=854321&transactionReference="Test Reference",

"rel": "self"

}, {

"href":"https://lgapi.uat.paymark.nz/transaction/payment/

ec2b8e9d-2b88-4460-9257-11d7a629b43b",

"rel": "ec2b8e9d-2b88-4460-9257-11d7a629b43b"

}, {

"href":"https://lgapi.uat.paymark.nz/transaction/payment/

4ae27040-1cf7-476f-9537-6089cc1012d",

"rel": "4ae27040-1cf7-476f-9537-6089cc1012d"

}, {

"href":"https://lgapi.uat.paymark.nz/transaction/payment/

7c018008-624b-4436-b393-dc3ad1b22d1e",

"rel": "7c018008-624b-4436-b393-dc3ad1b22d1e"

}

],

"payments": [ {

"id":"ec2b8e9d-2b88-4460-9257-11d7a629b43b",

[remaining fields as per create payment response]

}, {

"id":"4ae27040-1cf7-476f-9537-6089cc1012d",

[remaining fields as per create payment response]

}, {

"id":"7c018008-624b-4436-b393-dc3ad1b22d1e",

[remaining fields as per create payment response]

}

]

}

Payment Resource Definition

{

"links":[

{

"href":"full URL in message",

"rel":"self"

}

],

"id":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"status":"['created'|'processing'|'complete'|'failed']",

"creationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"modificationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"card": {

"token":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"cardNumber":4111111111111111,

"maskedNumber":"XXXXXX..XXXX",

"expiryDate":"YYYY-MM",

"cardSecurityCodePresence":"['Not Present'|'Present'|'Not Legible'|'Not Imprinted']",

"cardSecurityCode":"XXXX",

"cardSecurityCodeResponse":"['Match'|'No Match'|'Not Processed'|'Not on Card'|'No keys, not certified or both']",

"paymentAccountReference":"XXXXXXXXXXXXXXXXXXXXXXXXXXXXX",

"type": "['CARD'|'SCHEME_TOKEN']",

"cryptogram": "XXXXXXXXXXXXXXX",

"eci": "XX"

},

"dsrp": {

"tokenType":"['AETS'|'MDES'|'VTS'|'applePay'|'googlePay'|'samsungPay']",

"tokenPan":"4111111111111111",

"tokenExpiryDate":"YYYY-MM",

"tokenSecurityCode":"XXXX",

"eciIndicator":"XX",

"cryptogram":"XXXXXXXXXXXXXXXXXXXXXXXXXXXXX"

},

"merchant":{

"cardAcceptorIdCode":"Paymark assigned merchant ID",

"transactionReference":"my-unique-ref/01.1",

"transactionInformation":"Informative Text.",

"street":"merchant’s street address as provided by the bank ",

"suburb":"merchant’s address suburb as provided by the bank",

"city":"merchant’s address city as provided by the bank",

"postalCode":"merchant’s address post code as provided by the bank",

"country":"merchant’s address country as provided by the bank",

"cardAcceptorName":"merchant’s trading name as provided by the bank",

"acquiringInstitutionId":"merchant’s acquiring bank code",

"mcc":"classification code as provided by the bank",

"terminal":"XXXXXXXX",

"timeStamp":"YYYY-MM-DDThh:mm:ss.000Z"

},

"transaction":{

"systemTraceAuditNumber":"123456789012",

"amount":12345,

"currency":"['AUD'|'NZD'|'USD'|...]",

"source":"['Web Site'|'Call Centre'|'Merchant']",

"frequency":"['single'|'recurring'|'unscheduled']",

"processorResponseCode":"00",

"settlementDate":"YYYY-MM-DD",

"authorisationCode":"12",

"retrievalReferenceNumber":"123456789012",

"storedCredentials":"['new'|'stored']",

"agreementId":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX"

},

"3ds2": {

"protocolVersion":"X.X.X",

"transactionId":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"authenticationStatus":"X",

"eci":"XX",

"authenticationStatusReason":"XX",

"authenticationValue":"XXXXXXXXXXXXXXXXXXXXXXXXXXX="

}

}Required Fields for Payment

Refer to Field Glossary section for field information.

| Name | Valid Methods | Required? |

|---|---|---|

| id | GET | Yes for read. |

| status | GET | Optional. |

| creationTime | GET | Optional, can specify startTime or endTime in query. |

| card.cardNumber | POST | Yes |

| card.expiryDate | POST | Yes if transaction.frequency is “single”, or if transaction.frequency is “recurring” and it is the first “recurring” transaction for that card. |

| card.cardSecurityCodePresence | POST | Yes |

| card.cardSecurityCode | POST | Yes if cardSecurityCodePresence is “Present”. |

| card.type | POST | Yes if transaction is “SCHEME_TOKEN” |

| card.cryptogram | POST | Yes if transaction is “SCHEME_TOKEN”, Customer Initiated Transaction and Visa or Mastercard |

| card.eci | POST | Yes if transaction is “SCHEME_TOKEN”, Customer Initiated Transaction and Visa or Mastercard |

| merchant.cardAcceptorIdCode | POST, GET | Yes |

| merchant.transactionReference | POST, GET | Optional. |

| merchant.transactionInformation | POST | Optional. |

| merchant.timeStamp | POST | Optional. |

| transaction.amount | POST | Yes |

| transaction.source | POST | Optional, uses account default if not present. |

| transaction.frequency | POST | Optional, uses account default if not present. Set to “single” for one-off payments or when charging a saved card e.g. the Customer has previously opted to save their Card then chooses to use this for a later purchase. Set to “recurring” for a Merchant initiated payment where there is an agreement between a Cardholder and a Merchant to bill the Cardholder’s account on a periodic basis without a specified end date e.g. bill payment or subscription. Set to “instalment” for a Merchant initiated payment where there is an agreement between a Cardholder and a Merchant to bill the Cardholder’s account where the number of payments is limited e.g. a purchase split over multiple payments. |

| transaction.storedCredentials | POST | Should always be provided for a transaction using a saved (tokenised) card. |

| transaction.agreementId | POST | Required if transaction.frequency is not “single” |

| transaction.settlementDate | POST | Optional. |

| 3ds2.transactionId | POST | Refer to 3DS section. |

| 3ds2.eci | POST | Refer to 3DS section. |

| 3ds2.authenticationValue | POST | Refer to 3DS section. |

| 3ds2.protocolVersion | POST | Refer to 3DS section. |

| 3ds2.authenticationStatus | POST | Refer to 3DS section. |

| 3ds2.authenticationStatusReason | POST | Refer to 3DS section. |

Refund ¶

Overview

https://api.paymark.nz/transaction/refund

A refund represents a request for a transfer of funds from a Merchant to a Cardholder. A refund may be standalone or may be linked to a previous payment or capture.

A Merchant must be enabled for refund to send refund requests. Linked Gateway will reject refund requests if the Merchant has not been enabled for this transaction type by their Acquiring Bank.

Notes:

-

You should only attempt to refund a transaction that is less than six months old: there may be issues with the correct Cardholder receiving funds for transactions older than six months.

-

It is the client’s responsibility to ensure the refund amount does not exceed the original payment amount.

-

If explicity passing a reference for the capture request, the response will return the previous payment or previous capture reference

-

scheme tokenisation standalone refund request is currently not implemented

-

Refer to the table below when refunding a previous payment or previous capture

| Field Name | Value | Description |

|---|---|---|

| paymentId | UUID | Use if refunding a prior payment. |

| captureId | UUID | Use if refunding a prior captured transaction. |

| Environment | URL |

|---|---|

| Production | https://api.paymark.nz/transaction/refund |

| Sandbox | https://apitest.paymark.nz/transaction/refund |

Create Refund

Creates a new refund for processing on the Paymark network. The refund will be processed immediately and the returned resource will communicate whether the refund was approved or declined.

REFUND REQUEST

POST /transaction/refundProvide a JSON formatted refund resource as per the examples below.

Example Request – Standalone Refund with Card Details

POST /transaction/refund HTTP/1.1

Authorization: Bearer Dypntpo33Qmir6jqCARrO36BVFmM

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"card": {

"cardNumber":"5123456789012346",

"expiryDate":"2020-12"

},

"merchant": {

"cardAcceptorIdCode":"854321",

"transactionReference":"test reference",

"transactionInformation":"test information",

"timeStamp":"2015-06-10T02:34:24.841Z"

},

"transaction": {

"amount":5467,

"source":"Web Site".

"settlementDate":"2015-06-11"

}

}

Example Request – Full Refund Linked to Prior Payment

Creating a refund for the full amount of a prior payment, where the ID of the prior payment is ec2b8e9d-2b88-4460-9257-11d7a629b43b and the payment was for $50. Note: The refund amount should not exceed the original payment amount.

POST /transaction/refund HTTP/1.1

Authorization: Bearer Dypntpo33Qmir6jqCARrO36BVFmM

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"paymentId": "ec2b8e9d-2b88-4460-9257-11d7a629b43b",

"transaction": {

"amount": 5000

}

}

Example Request – Partial Refund Linked to Prior Capture

Creating a refund for a portion ($20) of the amount of a prior capture ($54.67), where the ID of the prior capture is 8312422d-b42d-47f9-adf1-e468669d134b.

POST /transaction/refund HTTP/1.1

Authorization: Bearer Dypntpo33Qmir6jqCARrO36BVFmM

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"captureId": "8312422d-b42d-47f9-adf1-e468669d134b",

"transaction": {

"amount": 2000

}

}

REFUND RESPONSE

If successful, returns HTTP 201 Created with the response body containing the full refund resource.

Example Response – Standalone Refund with Card Details

HTTP/1.1 201 Created

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":"https://lgapi.uat.paymark.nz/transaction/refund/

c04a47b2-bf35-4fcb-b1e9-ddaa11364cb",

"rel": "self"

}

],

"id":"c04a47b2-bf35-4fcb-b1e9-ddaa11364cba",

"status":"complete",

"creationTime":"2015-06-10T02:38:39.021Z",

"modificationTime":"2015-06-10T02:38:39.021Z",

"card": {

"token":"89d74cec-b9c4-43ce-a762-89b166609aa1",

"maskedNumber":"512345..2346",

"expiryDate":"2020-12",

"cardSecurityCodePresence":"Present",

"cardSecurityCodeResponse":"Not Processed"

},

"merchant": {

"cardAcceptorIdCode":"854321",

"transactionReference":"test reference",

"transactionInformation":"test information",

"street":"123 The Avenue",

"suburb":"Auckland Heights",

"city":"Auckland",

"postalCode":"1000",

"country":"NZ",

"cardAcceptorName":"Mirandas Marvellous Muffins",

"acquiringInstitutionId":"503513",

"mcc":"1234",

"terminal":"98765432101",

"timeStamp":"2015-06-10T02:34:24.841Z"

},

"transaction": {

"amount":5467,

"currency":"NZD",

"source":"Web Site",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2015-06-11",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456",

"systemTraceAuditNumber":"123456"

}

}

Read Refund

Reads a previously created refund. This does not change the refund in any way.

A refund can be read as soon as it has been created even if processing has not yet completed.

A refund can be read if it was created within the past 2 years. Refunds performed more than 2 years ago will be archived by Paymark.

READ REFUND REQUEST

To request a single refund resource:

GET /transaction/refund/{id}Example Request - Single Refund

GET /transaction/refund/ec2b8e9d-2b88-4460-9257-11d7a629b43b HTTP/1.1

Authorization: Bearer Dypntpo33Qmir6jqCARrO36BVFmM

Accept: application/vnd.paymark_api+json;version=2.0

READ REFUND RESPONSE

If successful, returns HTTP 200 OK with the response body containing a refund resource.

Example Response – Single Refund Resource

HTTP/1.1 200 OK

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":"https://lgapi.uat.paymark.nz/transaction/refund/

c04a47b2-bf35-4fcb-b1e9-ddaa11364cb",

"rel": "self"

}

],

"id":"c04a47b2-bf35-4fcb-b1e9-ddaa11364cba",

"status":"complete",

"creationTime":"2015-06-10T02:38:39.021Z",

"modificationTime":"2015-06-10T02:38:39.021Z",

"card": {

"token":"89d74cec-b9c4-43ce-a762-89b166609aa1",

"maskedNumber":"512345..2346",

"expiryDate":"2020-12",

"cardSecurityCodePresence":"Present",

"cardSecurityCodeResponse":"Not Processed"

},

"merchant": {

"cardAcceptorIdCode":"854321",

"transactionReference":"test reference",

"transactionInformation":"test information",

"street":"123 The Avenue",

"suburb":"Auckland Heights",

"city":"Auckland",

"postalCode":"1000",

"country":"NZ",

"cardAcceptorName":"Mirandas Marvellous Muffins",

"acquiringInstitutionId":"503513",

"mcc":"1234",

"terminal":"98765432101",

"timeStamp":"2015-06-10T02:38:39.021Z"

},

"transaction": {

"amount":5467,

"currency":"NZD",

"source":"Web Site",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2015-06-11",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456",

"systemTraceAuditNumber":"123456"

}

}

Query Refunds

Reads a range of previously created refunds. This does not change the refunds in any way.

A refund can be read as soon as it has been created even if processing has not yet completed.

A refund can be read if it was created within the past 2 years. Refunds performed more than 2 years ago will be archived by Paymark.

QUERY REFUND REQUEST

| Name | Value | Description |

|---|---|---|

| cardAcceptorIdCode | string | Required. cardAcceptorIdCode field of refund resource. |

| status | string | Status field of refund resource. |

| startTime | date/time, ISO 8601 formatted | Minimum value of creation field of refund resource. |

| endTime | date/time, ISO 8601 formatted | Maximum value of creation field of refund resource. |

| transactionReference | string | Merchant reference for a refund. |

To request a range of refund resources:

GET /transaction/refund?cardAcceptorIdCode={cardAcceptorIdCode}&startTime={startTime}&endTime={endTime}&status={status}Example Request

GET /transaction/refund/?cardAcceptorIdCode=854321&startTime=2015-05-13 HTTP/1.1

Authorization: Bearer Dypntpo33Qmir6jqCARrO36BVFmM

Accept: application/vnd.paymark_api+json;version=2.0

QUERY REFUND RESPONSE

If successful, returns HTTP 200 OK with the response body. The response body is the similar to that shown under Query Payments, with an array of zero or more refund resources that match the provided query.

Refund Resource Definition

{

"links":[

{

"href":"full URL in message",

"rel":"self"

}

],

"id":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"status":"['created'|'processing'|'complete'|'failed']",

"creationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"modificationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"card": {

"token":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"cardNumber":4111111111111111,

"maskedNumber":"XXXXXX..XXXX",

"expiryDate":"YYYY-MM",

"cardSecurityCodePresence":

"['Not Present'|'Present'|'Not Legible'|'Not Imprinted']",

"cardSecurityCode":"ABCD",

"cardSecurityCodeResponse":

"['Match'|'No Match'|'Not Processed'|'Not on Card'|

'No keys, not certified or both']",

"type": "['CARD'|'SCHEME_TOKEN']",

"eci": "XX"

},

"merchant":{

"cardAcceptorIdCode":"Paymark assigned merchant ID",

"transactionReference":"my-unique-ref/01.1",

"transactionInformation":"Informative Text.",

"street":"merchant’s street address as provided by the bank ",

"suburb":"merchant’s address suburb as provided by the bank",

"city":"merchant’s address city as provided by the bank",

"postalCode":"merchant’s address post code as provided by the bank",

"country":"merchant’s address country as provided by the bank",

"cardAcceptorName":"merchant’s trading name as provided by the bank",

"acquiringInstitutionId":"merchant’s acquiring bank code",

"mcc":"classification code as provided by the bank",

"terminal":"XXXXXXXX",

"timeStamp":"YYYY-MM-DDThh:mm:ss.000Z"

},

"transaction":{

"systemTraceAuditNumber":"123456789012",

"amount":12345,

"currency":"['AUD'|'NZD'|'USD'|...]",

"source":"['Web Site'|'Call Centre']",

"frequency":"['single'|'recurring']",

"processorResponseCode":"00",

"settlementDate":"YYYY-MM-DD",

"authorisationCode":"12",

"retrievalReferenceNumber":"123456789012",

"storedCredentials":"['new'|'stored']

}

}Required Fields for Refund

Refer to Field Glossary section for field information.

| Name | Valid Methods | Required? |

|---|---|---|

| id | GET | Yes for read. |

| status | GET | Optional. |

| creationTime | GET | Optional, can specify startTime or endTime in query. |

| card.cardNumber | POST | Yes |

| card.expiryDate | POST | Yes if transaction.frequency is “single”. |

| merchant.cardAcceptorIdCode | POST, GET | Yes |

| merchant.transactionReference | POST, GET | Optional. |

| merchant.transactionInformation | POST | Optional. |

| merchant.timeStamp | POST | Optional. |

| transaction.amount | POST | Yes |

| transaction.source | POST | Optional, uses account default if not present. |

| transaction.settlementDate | POST | Optional. |

Status Check ¶

Overview

https://api.paymark.nz/transaction/status

A status check enables a Merchant to verify a card, without reserving any Cardholder funds. This is suitable when saving a card that will be used for charging at a later time.

A Merchant must be enabled for “authorisation” to send status check requests: the status check leverages the authorisation feature. Linked Gateway will reject status check requests if the Merchant has not been enabled for the authorisation transaction type by their Acquiring Bank.

Notes:

- scheme tokenisation transaction request for Status Check is currently not implemented

| Environment | URL |

|---|---|

| Production | https://api.paymark.nz/transaction/status |

| Sandbox | https://apitest.paymark.nz/transaction/status |

Create Status Check

Creates a new status check for processing on the Paymark network. The status check will be processed immediately and the returned resource will communicate whether the status check was successful.

STATUS CHECK REQUEST

POST /transaction/statusProvide a JSON formatted status check resource as per the example below.

Example Request – Creating a Status Check

POST /transaction/status HTTP/1.1

Authorization: Bearer YbB4QM4LdVpo1MZrSAP5sjJg3GGO

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"card": {

"cardNumber":"5123456789012346",

"expiryDate":"2020-01",

"cardHolderName":"Pam Ark",

"cardSecurityCodePresence":"Present",

"cardSecurityCode":"111"

},

"merchant": {

"cardAcceptorIdCode":"850525",

"transactionReference":"status check reference",

"transactionInformation":"status check information",

"timeStamp":"2018-02-21T03:05:39.289Z"

},

"transaction": {

"source":"Web Site",

"storedCredentials":"new",

"agreementId":"5b29c055-6e8b-4213-a320-834490f747d8"

}

}

STATUS CHECK RESPONSE

If successful, returns HTTP 201 Created with the response body containing the full status check resource.

Example Response – Status Check

HTTP/1.1 201 Created

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":"https://lgapi.uat.paymark.nz/transaction/status/

76a1c90c-54c9-4588-8930-4a9b29f0d81b",

"rel":"self"

}

],

"id":"76a1c90c-54c9-4588-8930-4a9b29f0d81b",

"status":"complete",

"creationTime":"2018-02-21T03:05:39.367Z",

"modificationTime":"2018-02-21T03:05:39.367Z"

"card": {

"token":"1ac18c74-cead-4246-a56e-d87dee4b6866",

"maskedNumber":"512345..2346",

"expiryDate":"2020-01",

"cardHolderName":"Pam Ark",

"cardSecurityCodePresence":"Present",

"cardSecurityCodeResponse":"Not Processed"

},

"merchant": {

"cardAcceptorIdCode":"850525",

"transactionReference":"status check reference",

"transactionInformation":"status check information",

"street":"5 The Parade",

"suburb":"Christchurch Valley",

"city":"Christchurch",

"postalCode":"8000",

"country":"NZ",

"cardAcceptorName":"Saisais Sushi",

"acquiringInstitutionId": "503513",

"mcc":"1234",

"terminal":"85052501",

"timeStamp":"2018-02-21T03:05:39.289Z"

},

"transaction": {

"currency":"NZD",

"source":"Web Site",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2018-02-21",

"authorisationCode":"145430",

"retrievalReferenceNumber":"457897624042",

"systemTraceAuditNumber":"567351",

"storedCredentials":"new",

"agreementId":"5b29c055-6e8b-4213-a320-834490f747d8"

}

}

Read Status Check

Reads a previously created status check. This does not change the status check in any way.

A status check can be read as soon as it has been created even if processing has not yet completed.

A status check can be read if it was created within the past 2 years. Status checks performed more than 2 years ago will be archived by Paymark.

READ STATUS CHECK REQUEST

To request a single status check resource:

GET /transaction/status/{id}Example Request - Single Status Check

GET /transaction/status/76a1c90c-54c9-4588-8930-4a9b29f0d81b HTTP/1.1

Authorization: Bearer YbB4QM4LdVpo1MZrSAP5sjJg3GGO

Accept: application/vnd.paymark_api+json;version=2.0

READ STATUS CHECK RESPONSE

If successful, returns HTTP 200 OK with the response body containing a status check resource.

Example Response – Single Status Check Resource

HTTP/1.1 200 OK

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":"https://lgapi.uat.paymark.nz/transaction/status/

76a1c90c-54c9-4588-8930-4a9b29f0d81b",

"rel":"self"

}

],

"id":"76a1c90c-54c9-4588-8930-4a9b29f0d81b",

"status":"complete",

"creationTime":"2018-02-21T03:05:39.367Z",

"modificationTime":"2018-02-21T03:05:39.367Z"

"card": {

"token":"1ac18c74-cead-4246-a56e-d87dee4b6866",

"maskedNumber":"512345..2346",

"expiryDate":"2020-01",

"cardHolderName":"Pam Ark",

"cardSecurityCodePresence":"Present",

"cardSecurityCodeResponse":"Not Processed"

},

"merchant": {

"cardAcceptorIdCode":"850525",

"transactionReference":"status check reference",

"transactionInformation":"status check information",

"street":"5 The Parade",

"suburb":"Christchurch Valley",

"city":"Christchurch",

"postalCode":"8000",

"country":"NZ",

"cardAcceptorName":"Saisais Sushi",

"acquiringInstitutionId": "503513",

"mcc":"1234",

"terminal":"85052501",

"timeStamp":"2018-02-21T03:05:39.289Z"

},

"transaction": {

"currency":"NZD",

"source":"Web Site",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2018-02-21",

"authorisationCode":"145430",

"retrievalReferenceNumber":"457897624042",

"systemTraceAuditNumber":"567351",

"storedCredentials":"new",

"agreementId":"5b29c055-6e8b-4213-a320-834490f747d8"

}

}

Query Status Check

Reads a range of previously created status checks. This does not change the status checks in any way.

A status check can be read as soon as it has been created even if processing has not yet completed.

A status check can be read if it was created within the past 2 years. Status checks performed more than 2 years ago will be archived by Paymark.

QUERY STATUS CHECK REQUEST

| Name | Value | Description |

|---|---|---|

| cardAcceptorIdCode | string | Required. cardAcceptorIdCode field of status check resource. |

| status | string | Status field of status check resource. |

| startTime | date/time, ISO 8601 formatted | Minimum value of creation field of status check resource. |

| endTime | date/time, ISO 8601 formatted | Maximum value of creation field of status check resource. |

| transactionReference | string | Merchant reference for a status check. |

To request a range of status check resources:

GET /transaction/status?cardAcceptorIdCode={cardAcceptorIdCode}&status={status}&startTime={startTime}&endTime={endTime}&transactionReference={transactionReference}Example Request

GET /transaction/status?cardAcceptorIdCode=850525&transactionReference="status check reference" HTTP/1.1

Authorization: Bearer YbB4QM4LdVpo1MZrSAP5sjJg3GGO

Accept: application/vnd.paymark_api+json;version=2.0

QUERY STATUS CHECK RESPONSE

If successful, returns HTTP 200 OK with an array of zero or more status check resources that match the provided query in the response body.

Example Response – Array of Status Checks

HTTP/1.1 200 OK

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [ {

"href":"https://lgapi.uat.paymark.nz/transaction/status

?cardAcceptorIdCode=850525&transactionReference="status check

reference",

"rel": "self"

}, {

"href":"https://lgapi.uat.paymark.nz/transaction/status/

76a1c90c-54c9-4588-8930-4a9b29f0d81b",

"rel": "76a1c90c-54c9-4588-8930-4a9b29f0d81b"

}, {

"href":"https://lgapi.uat.paymark.nz/transaction/status/

8b61c137-2a72-42cd-87c5-4a9f021955ba",

"rel": "8b61c137-2a72-42cd-87c5-4a9f021955ba"

}

],

"statuses": [ {

"id":"76a1c90c-54c9-4588-8930-4a9b29f0d81b",

[remaining fields as per create status check response]

}, {

"id":"8b61c137-2a72-42cd-87c5-4a9f021955ba",

[remaining fields in line with create status check response]

}

]

}

Status Check Resource Definition

{

"links":[

{

"href":"full URL in message",

"rel":"self"

}

],

"id":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"status":"['created'|'processing'|'complete'|'failed']",

"creationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"modificationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"card": {

"token":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"cardNumber":4111111111111111,

"maskedNumber":"XXXXXX..XXXX",

"expiryDate":"YYYY-MM",

"cardHolderName":"Joe Bloggs",

"cardSecurityCodePresence":

"['Not Present'|'Present'|'Not Legible'|'Not Imprinted']",

"cardSecurityCode":"XXXX",

"cardSecurityCodeResponse":

"['Match'|'No Match'|'Not Processed'|'Not on Card'|

'No keys, not certified or both']"

},

"merchant": {

"cardAcceptorIdCode":"Paymark assigned merchant ID",

"transactionReference":"my-unique-ref/01.1",

"transactionInformation":"Informative Text.",

"street":"merchant’s street address as provided by the bank ",

"suburb":"merchant’s address suburb as provided by the bank",

"city":"merchant’s address city as provided by the bank",

"postalCode":"merchant’s address post code as provided by the bank",

"country":"merchant’s address country as provided by the bank",

"cardAcceptorName":"merchant’s trading name as provided by the bank",

"acquiringInstitutionId":"merchant’s acquiring bank code",

"mcc":"classification code as provided by the bank",

"terminal":"XXXXXXXX",

"timeStamp":"YYYY-MM-DDThh:mm:ss.000Z"

},

"transaction": {

"currency":"['AUD'|'NZD'|'USD'|...]",

"source":"['Web Site'|'Call Centre'|'Merchant']",

"frequency":"['single'|'recurring'|'unscheduled']",

"processorResponseCode":"00",

"settlementDate":"YYYY-MM-DD",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber":"123456789012",

"storedCredentials":"['new'|'stored']",

"agreementId":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX"

}

}

Required Fields for Status Check

Refer to Field Glossary section for field information.

| Name | Valid Methods | Required? |

|---|---|---|

| id | GET | Yes for read. |

| status | GET | Optional. |

| creationTime | GET | Optional, can specify startTime or endTime in query. |

| card.cardNumber | POST | Yes |

| card.expiryDate | POST | Yes if transaction.frequency is “single”. |

| card.cardHolderName | POST | Yes |

| card.cardSecurityCodePresence | POST | Yes |

| card.cardSecurityCode | POST | Yes if cardSecurityCodePresence is “Present”. |

| merchant.cardAcceptorIdCode | POST, GET | Yes |

| merchant.transactionReference | POST, GET | Optional. |

| merchant.transactionInformation | POST | Optional. |

| merchant.timeStamp | POST | Optional. |

| transaction.source | POST | Optional, uses account default if not present. |

| transaction.storedCredentials | POST | Should always be provided for a transaction using a saved (tokenised) card. |

| transaction.agreementId | POST | Required if transaction.frequency is not “single” |

Capture ¶

Overview

https://api.paymark.nz/transaction/capture

A capture relates to a matching authorisation, resulting in a transfer of funds from the Cardholder to the Merchant.

A Merchant must be enabled for capture to send capture requests. Linked Gateway will reject capture requests if the Merchant has not been enabled for this transaction type by their Acquiring Bank.

Notes:

-

All authorisations must have a corresponding capture(s) or cancellation transaction.

-

If a capture is done, no cancellation is needed (or possible).

-

Linked Gateway does not enforce a limit on the total amount captured. The capture may be for the whole value of the authorisation, or for part of the value. It is the client’s responsibility to ensure the total of all captures against an authorisation is not greater than the original authorisation amount.

-

If explicity passing a reference for the capture request, the response will return the reference used for prior authorisation

| Environment | URL |

|---|---|

| Production | https://api.paymark.nz/transaction/capture |

| Sandbox | https://apitest.paymark.nz/transaction/capture |

Create Capture

Creates a new capture for processing on the Paymark network. The capture must reference a previous authorisation, and the total amount of all captures created must be no more than the amount of the original authorisation.

The capture will be processed immediately and the returned resource will communicate whether the capture was approved or declined.

CAPTURE REQUEST

POST /transaction/captureProvide a JSON formatted capture resource as per the examples below.

Example Request – Interim Capture for $8.00 (Authorisation was for $10.00)

POST /transaction/capture HTTP/1.1

Authorization: Bearer NmAdMXGQoGNqtM2go7LFeJZAEYhe

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"authorisationId":"5296a82d-8b05-40a6-b33e-2038c8670b3a",

"transaction": {

"amount":800,

"conditionIndicator":"Partial",

"settlementDate":"2015-05-28"

}

}

Example Request – Final Capture for $2.00 (Authorisation was for $10.00)

POST /transaction/capture HTTP/1.1

Authorization: Bearer NmAdMXGQoGNqtM2go7LFeJZAEYhe

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"authorisationId":"5296a82d-8b05-40a6-b33e-2038c8670b3a",

"transaction": {

"amount":200,

"conditionIndicator":"Final",

"settlementDate":"2015-05-28"

}

}

CAPTURE RESPONSE

If successful, returns HTTP 201 Created with the response body containing the full capture resource.

Example Response – Interim Capture for $8.00

HTTP/1.1 201 Created

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":"https://lgapi.uat.paymark.nz/transaction/capture/

dfdf6f47-462e-442c-89b7-240e82166672",

"rel":"self"

}

],

"id":"dfdf6f47-462e-442c-89b7-240e82166672",

"status":"complete",

"creationTime":"2015-05-27T01:27:03.763Z",

"modificationTime":"2015-05-27T01:27:03.763Z",

"card": {

"token":"1ac18c74-cead-4246-a56e-d87dee4b6866",

"maskedNumber":"512345..2346",

"expiryDate":"2020-01"

},

"merchant": {

"cardAcceptorIdCode":"850525",

"transactionReference":"auth reference",

"transactionInformation":"auth information",

"street":"5 The Parade",

"suburb":"Christchurch Valley",

"city":"Christchurch",

"postalCode":"8000",

"country":"NZ",

"cardAcceptorName":"Saisais Sushi",

"acquiringInstitutionId": "503513",

"mcc":"1234",

"terminal":"85052501",

"timeStamp":"2015-05-27T01:27:03.763Z"

},

"transaction": {

"amount":800,

"currency":"NZD",

"source":"Web Site",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2015-05-27",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber": "061683",

"conditionIndicator":"Partial"

}

}

Example Response – Final Capture for $2.00

HTTP/1.1 201 Created

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":" https://lgapi.uat.paymark.nz/transaction/capture/

5c23d9bd-b4eb-416c-aa0b-ce8d3350e259",

"rel":"self"

}

],

"id":"5c23d9bd-b4eb-416c-aa0b-ce8d3350e259",

"status":"complete",

"creationTime":"2015-05-27T04:27:03.763Z",

"modificationTime":"2015-05-27T04:27:03.763Z",

"card": {

"token":"1ac18c74-cead-4246-a56e-d87dee4b6866",

"maskedNumber":"512345..2346",

"expiryDate":"2020-01"

},

"merchant": {

"cardAcceptorIdCode":"850525",

"transactionReference":"auth reference",

"transactionInformation":"auth information",

"street":"5 The Parade",

"suburb":"Christchurch Valley",

"city":"Christchurch",

"postalCode":"8000",

"country":"NZ",

"cardAcceptorName":"Saisais Sushi",

"acquiringInstitutionId": "503513",

"mcc":"1234",

"terminal":"85052501",

"timeStamp":"2015-05-27T04:27:03.763Z"

},

"transaction": {

"amount":200,

"currency":"NZD",

"source":"Web Site",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2015-05-28",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber": "061683",

"conditionIndicator":"Final"

}

}

Read Capture

Reads a previously created capture. This does not change the capture in any way.

A capture can be read as soon as it has been created even if processing has not yet completed.

A capture can be read if it was created within the past 2 years. Captures performed more than 2 years ago will be archived by Paymark.

READ CAPTURE REQUEST

To request a single capture resource:

GET /transaction/capture/{id}Example Request - Single Capture

GET /transaction/capture/dfdf6f47-462e-442c-89b7-240e82166672 HTTP/1.1

Authorization: Bearer NmAdMXGQoGNqtM2go7LFeJZAEYhe

Accept: application/vnd.paymark_api+json;version=2.0

READ CAPTURE RESPONSE

If successful, returns HTTP 200 OK with the response body containing a capture resource.

Example Response – Single Capture Resource

HTTP/1.1 200 OK

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":" https://lgapi.uat.paymark.nz/transaction/capture/

dfdf6f47-462e-442c-89b7-240e82166672",

"rel":"self"

}

],

"id":"dfdf6f47-462e-442c-89b7-240e82166672",

"status":"complete",

"creationTime":"2015-05-27T01:27:03.763Z",

"modificationTime":"2015-05-27T01:27:03.763Z",

"card": {

"token":"1ac18c74-cead-4246-a56e-d87dee4b6866",

"maskedNumber":"512345..2346",

"expiryDate":"2020-01"

},

"merchant": {

"cardAcceptorIdCode":"850525",

"transactionReference":"auth reference",

"transactionInformation":"auth information",

"street":"5 The Parade",

"suburb":"Christchurch Valley",

"city":"Christchurch",

"postalCode":"8000",

"country":"NZ",

"cardAcceptorName":"Saisais Sushi",

"acquiringInstitutionId": "503513",

"mcc":"1234",

"terminal":"85052501",

"timeStamp":"2015-05-27T01:27:03.763Z"

},

"transaction": {

"amount":800,

"currency":"NZD",

"source":"Web Site",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2015-05-27",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber": "061683",

"conditionIndicator":"Partial"

}

}

Query Captures

Reads a range of previously created captures. This does not change the captures in any way.

A capture can be read as soon as it has been created even if processing has not yet completed.

A capture can be read if it was created within the past 2 years. Captures performed more than 2 years ago will be archived by Paymark.

QUERY CAPTURE REQUEST

| Name | Value | Description |

|---|---|---|

| cardAcceptorIdCode | string | Required. cardAcceptorIdCode field of capture resource. |

| status | string | Status field of capture resource. |

| startTime | date/time, ISO 8601 formatted | Minimum value of creation field of capture resource. |

| endTime | date/time, ISO 8601 formatted | Maximum value of creation field of capture resource. |

| transactionReference | string | Merchant reference for a capture. |

To request a range of capture resources:

GET /transaction/capture?cardAcceptorIdCode={cardAcceptorIdCode}&startTime={startTime}&endTime={endTime}&status={status}&transactionReference={transactionReference}Example Request

GET /transaction/capture?cardAcceptorIdCode=850525&transactionReference="auth reference" HTTP/1.1

Authorization: Bearer NmAdMXGQoGNqtM2go7LFeJZAEYhe

Accept: application/vnd.paymark_api+json;version=2.0QUERY CAPTURE RESPONSE

If successful, returns HTTP 200 OK with an array of zero or more capture resources that match the provided query in the response body.

Example Response – Array of Captures

HTTP/1.1 200 OK

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [ {

"href":"https://lgapi.uat.paymark.nz/transaction/capture?cardAcceptorIdCode=850525&transactionReference=auth%20reference",

"rel": "self"

}, {

"href":"https://lgapi.uat.paymark.nz/transaction/capture/dfdf6f47-462e-442c-89b7-240e82166672",

"rel": "dfdf6f47-462e-442c-89b7-240e82166672"

}, {

"href":"https://lgapi.uat.paymark.nz/transaction/capture/5c23d9bd-b4eb-416c-aa0b-ce8d3350e259",

"rel": "5c23d9bd-b4eb-416c-aa0b-ce8d3350e259"

}

],

"captures": [ {

"id":"dfdf6f47-462e-442c-89b7-240e82166672",

[remaining fields as per create capture response]

}, {

"id":"5c23d9bd-b4eb-416c-aa0b-ce8d3350e259",

[remaining fields as per create capture response]

}

]

}

Capture Resource Definition

{

"links":[

{

"href":"full URL in message",

"rel":"self"

}

],

"id":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"status":"['created'|'processing'|'complete'|'failed']",

"creationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"modificationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"card": {

"token":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"cardNumber":4111111111111111,

"maskedNumber":"XXXXXX..XXXX",

"expiryDate":"YYYY-MM",

"cardSecurityCodePresence":"['Not Present'|'Present'|'Not Legible'|'Not Imprinted']",

"cardSecurityCode":"XXXX",

"cardSecurityCodeResponse":"['Match'|'No Match'|'Not Processed'|'Not on Card'|'No keys, not certified or both']",

"paymentAccountReference":"XXXXXXXXXXXXXXXXXXXXXXXXXXXXX",

"type": "['CARD'|'SCHEME_TOKEN']",

"cryptogram": "XXXXXXXXXXXXXXX",

"eci": "XX"

},

"dsrp": {

"tokenType":"['AETS'|'MDES'|'VTS'|'applePay'|'googlePay'|'samsungPay']",

"tokenPan":"4111111111111111",

"tokenExpiryDate":"YYYY-MM",

"tokenSecurityCode":"XXXX",

"eciIndicator":"XX",

"cryptogram":"XXXXXXXXXXXXXXXXXXXXXXXXXXXXX"

},

"authorisationId":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"merchant": {

"cardAcceptorIdCode":"Paymark assigned merchant ID",

"transactionReference":"my-unique-ref/01.1",

"transactionInformation":"Informative Text.",

"street":"merchant's street address as provided by the bank ",

"suburb":"merchant's address suburb as provided by the bank",

"city":"merchant's address city as provided by the bank",

"postalCode":"merchant's address post code as provided by the bank",

"country":"merchant's address country as provided by the bank",

"cardAcceptorName":"merchant's trading name as provided by the bank",

"acquiringInstitutionId":"merchant's acquiring bank code",

"mcc":"classification code as provided by the bank",

"terminal":"XXXXXXXX",

"timeStamp":"YYYY-MM-DDThh:mm:ss.000Z"

},

"transaction":{

"amount":12345,

"currency":"['AUD'|'NZD'|'USD'|...]",

"source":"['Web Site'|'Call Centre'|'Merchant']",

"frequency":"['single'|'recurring'|'unscheduled']",

"processorResponseCode":"00",

"settlementDate":"YYYY-MM-DD",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber":"123456789012",

"conditionIndicator":"['Partial'|'Final']",

"storedCredentials":"['new'|'stored']",

"agreementId":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX"

}

}Required Fields for Capture

Refer to Field Glossary section for field information.

| Name | Valid Methods | Required? |

|---|---|---|

| id | GET | Yes for read. |

| status | GET | Optional. |

| creationTime | GET | Optional, can specify startTime or endTime in query. |

| authorisationId | POST | Yes |

| merchant.cardAcceptorIdCode | GET | Optional. |

| merchant.transactionReference | GET | Optional. |

| transaction.amount | POST | Yes: should be no more than the approved amount of the corresponding authorisation transaction (as referenced by the authorisationId field). |

| transaction.conditionIndicator | POST | Yes |

| transaction.settlementDate | POST | Optional. |

Cancellation ¶

Overview

https://api.paymark.nz/transaction/cancel

A cancellation relates to a matching authorisation, resulting in removal of a hold on Cardholder funds that the Merchant no longer requires.

Once an authorisation has been cancelled, the client should not then attempt a capture against this authorisation.

Notes:

-

All authorisations must have a corresponding capture(s) or cancellation transaction.

-

When the Merchant becomes aware an authorisation is no longer needed, the cancellation request should be done within 24 hours.

-

If an authorisation request is not captured within the expiry period (set in the periodType and periodDuration fields of the matching authorisation), a cancellation request should be sent.

-

While the client will see a cancellation “successful” response, until the Acquiring Bank has implemented this type of transaction, the authorisation will still be live and Cardholder funds continue to be held.

-

If explicity passing a reference for the capture request, the response will return the reference used for prior authorisation

| Environment | URL |

|---|---|

| Production | https://api.paymark.nz/transaction/cancel |

| Sandbox | https://apitest.paymark.nz/transaction/cancel |

Create Cancellation

Creates a new cancellation for processing on the Paymark network. The cancellation must reference a previous authorisation.

The cancellation will be processed immediately and the returned resource will communicate whether the cancellation was approved or declined.

CANCELLATION REQUEST

POST /transaction/cancelProvide a JSON formatted cancellation resource as per the example below.

Example Request – Creating a Cancellation

POST /transaction/cancel HTTP/1.1

Authorization: Bearer NmAdMXGQoGNqtM2go7LFeJZAEYhe

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"authorisationId":"5296a82d-8b05-40a6-b33e-2038c8670b3a"

}

CANCELLATION RESPONSE

If successful, returns HTTP 201 Created with the response body containing the full cancellation resource.

Example Response

HTTP/1.1 201 Created

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":"https://lgapi.uat.paymark.nz/transaction/cancel/

c38c045b-bba4-44c9-95e6-6d24dbf45788",

"rel":"self"

}

],

"id":"c38c045b-bba4-44c9-95e6-6d24dbf45788",

"status":"complete",

"creationTime":"2015-05-27T01:27:03.763Z",

"modificationTime”:"2015-05-27T01:27:03.763Z",

"card": {

"token":"1ac18c74-cead-4246-a56e-d87dee4b6866",

"maskedNumber":"512345..2346",

"expiryDate":"2020-01"

},

"merchant": {

"cardAcceptorIdCode":"850525",

"transactionReference":"auth reference",

"transactionInformation":"auth information",

"street":"5 The Parade",

"suburb":"Christchurch Valley",

"city":"Christchurch",

"postalCode":"8000",

"country":"NZ",

"cardAcceptorName":"Saisais Sushi",

"acquiringInstitutionId": "503513",

"mcc":"1234",

"terminal":"85052501",

"timeStamp":"2015-05-27T01:27:03.763Z"

},

"transaction": {

"currency":"NZD",

"source":"Web Site",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2015-05-27",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber": "061683"

}

}

Read Cancellation

Reads a previously created cancellation. This does not change the cancellation in any way. A cancellation can be read as soon as it has been created even if processing has not yet completed.

A cancellation can be read if it was created within the past 2 years. Cancellations performed more than 2 years ago will be archived by Paymark.

READ CANCELLATION REQUEST

To request a single cancellation resource:

GET /transaction/cancel/{id}Example Request - Single Cancellation

GET /transaction/cancel/c38c045b-bba4-44c9-95e6-6d24dbf45788 HTTP/1.1

Authorization: Bearer NmAdMXGQoGNqtM2go7LFeJZAEYhe

Accept: application/vnd.paymark_api+json;version=2.0

READ CANCELLATION RESPONSE

If successful, returns HTTP 200 OK with the response body containing a cancellation resource.

Example Response – Single Cancellation Resource

HTTP/1.1 201 Created

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [

{

"href":" https://lgapi.uat.paymark.nz/transaction/cancel/

c38c045b-bba4-44c9-95e6-6d24dbf45788",

"rel":"self"

}

],

"id":"c38c045b-bba4-44c9-95e6-6d24dbf45788",

"status":"complete",

"creationTime":"2015-05-27T01:27:03.763Z",

"modificationTime”:"2015-05-27T01:27:03.763Z",

"card": {

"token":"1ac18c74-cead-4246-a56e-d87dee4b6866",

"maskedNumber":"512345..2346",

"expiryDate":"2020-01"

},

"merchant": {

"cardAcceptorIdCode":"850525",

"transactionReference":"auth reference",

"transactionInformation":"auth information",

"street":"5 The Parade",

"suburb":"Christchurch Valley",

"city":"Christchurch",

"postalCode":"8000",

"country":"NZ",

"cardAcceptorName":"Saisais Sushi",

"acquiringInstitutionId": "503513",

"mcc":"1234",

"terminal":"85052501",

"timeStamp":"2015-05-27T01:27:03.763Z"

},

"transaction": {

"currency":"NZD",

"source":"Web Site",

"frequency":"single",

"processorResponseCode":"00",

"settlementDate":"2015-05-27",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber": "061683"

}

}

Query Cancellation

Reads a range of previously created cancellations. This does not change the cancellations in any way.

A cancellation can be read as soon as it has been created even if processing has not yet completed.

A cancellation can be read if it was created within the past 2 years. Cancellations performed more than 2 years ago will be archived by Paymark.

QUERY CANCELLATION REQUEST

| Name | Value | Description |

|---|---|---|

| cardAcceptorIdCode | string | Required. cardAcceptorIdCode field of cancellation resource. |

| status | string | Status field of cancellation resource. |

| startTime | date/time, ISO 8601 formatted | Minimum value of creation field of cancellation resource. |

| endTime | date/time, ISO 8601 formatted | Maximum value of creation field of cancellation resource. |

| transactionReference | string | Merchant reference for a cancellation. |

To request a range of cancellation resources:

GET /transaction/cancel?cardAcceptorIdCode={cardAcceptorIdCode}&startTime={startTime}&endTime={endTime}&status={status}&transactionReference={transactionReference}Example Request

GET /transaction/cancel?cardAcceptorIdCode=850525&transactionReference="auth reference" HTTP/1.1

Authorization: Bearer NmAdMXGQoGNqtM2go7LFeJZAEYhe

Accept: application/vnd.paymark_api+json;version=2.0QUERY CANCELLATION RESPONSE

If successful, returns HTTP 200 OK with an array of zero or more cancellation resources that match the provided query in the response body.

Example Response - Array of Cancellations

HTTP/1.1 200 OK

Content-Type: application/vnd.paymark_api+json;version=2.0

{

"links": [ {

"href":"https://lgapi.uat.paymark.nz/transaction/cancel

?cardAcceptorIdCode=850525&transactionReference="auth reference",

"rel": "self"

}, {

"href":"https://lgapi.uat.paymark.nz/transaction/cancel/

c38c045b-bba4-44c9-95e6-6d24dbf45788",

"rel": "c38c045b-bba4-44c9-95e6-6d24dbf45788"

}, {

"href":"https://lgapi.uat.paymark.nz/transaction/cancel/

fbdf7cde-e2a3-4aa2-bdba-e7799fdef6f2",

"rel": "fbdf7cde-e2a3-4aa2-bdba-e7799fdef6f2"

}

],

"captures": [ {

"id":"c38c045b-bba4-44c9-95e6-6d24dbf45788",

[remaining fields as per create cancellation response]

}, {

"id":"fbdf7cde-e2a3-4aa2-bdba-e7799fdef6f2",

[remaining fields as per create cancellation response]

}

]

}

Cancellation Resource Definition

{

"links":[

{

"href":"full URL in message",

"rel":"self"

}

],

"id":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"status":"['created'|'processing'|'complete'|'failed']",

"creationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"modificationTime":"YYYY-MM-DDThh:mm:ss.000Z",

"card": {

"token":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"cardNumber":4111111111111111,

"maskedNumber":"XXXXXX..XXXX",

"expiryDate":"YYYY-MM",

"cardSecurityCodePresence":"['Not Present'|'Present'|'Not Legible'|'Not Imprinted']",

"cardSecurityCode":"XXXX",

"cardSecurityCodeResponse":"['Match'|'No Match'|'Not Processed'|'Not on Card'|'No keys, not certified or both']",

"paymentAccountReference":"XXXXXXXXXXXXXXXXXXXXXXXXXXXXX",

"type": "['CARD'|'SCHEME_TOKEN']",

"cryptogram": "XXXXXXXXXXXXXXX",

"eci": "XX"

},

"dsrp": {

"tokenType":"['AETS'|'MDES'|'VTS'|'applePay'|'googlePay'|'samsungPay']",

"tokenPan":"4111111111111111",

"tokenExpiryDate":"YYYY-MM",

"tokenSecurityCode":"XXXX",

"eciIndicator":"XX",

"cryptogram":"XXXXXXXXXXXXXXXXXXXXXXXXXXXXX"

},

"authorisationId":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"merchant": {

"cardAcceptorIdCode":"Paymark assigned merchant ID",

"transactionReference":"my-unique-ref/01.1",

"transactionInformation":"Informative Text.",

"street":"merchant’s street address as provided by the bank ",

"suburb":"merchant’s address suburb as provided by the bank",

"city":"merchant’s address city as provided by the bank",

"postalCode":"merchant’s address post code as provided by the bank",

"country":"merchant’s address country as provided by the bank",

"cardAcceptorName":"merchant’s trading name as provided by the bank",

"acquiringInstitutionId":"merchant’s acquiring bank code",

"mcc":"classification code as provided by the bank",

"terminal":"XXXXXXXX",

"timeStamp":"YYYY-MM-DDThh:mm:ss.000Z"

},

"transaction":{

"currency":"['AUD'|'NZD'|'USD'|...]",

"source":"['Web Site'|'Call Centre'|'Merchant']",

"frequency":"['single'|'recurring'|'unscheduled']",

"processorResponseCode":"00",

"settlementDate":"YYYY-MM-DD",

"authorisationCode":"123456",

"retrievalReferenceNumber":"123456789012",

"systemTraceAuditNumber":"123456789012",

"storedCredentials":"['new'|'stored']",

"agreementId":"XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX"

}

}Required Fields for Cancellation

Refer to Field Glossary section for field information.

| Name | Valid Methods | Required? |

|---|---|---|

| id | GET | Yes for read. |

| status | GET | Optional. |

| creationTime | GET | Optional, can specify startTime or endTime in query. |

| authorisationId | POST | Yes |

| merchant.cardAcceptorIdCode | GET | Optional. |

| merchant.transactionReference | GET | Optional. |

Three Domain Secure 3DS ¶

Overview

Linked Gateway provides a 3DS Server. The MPI will orchestrate your request, attempting to authenticate via the most recent 3DS version, and falling back to the version supported by the card issuer if required.

3DS is supported for MasterCard, Visa and American Express.

Orchestrated 3DS Sequence Diagram

Authentication Preparation Request ¶

Headers

Authorization: Bearer uOABwqy14kv010MnLxI4dmb80xlR

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0Body

{

"card": {

"cardNumber": "4000000000000002",

"expiryDate": "2021-07"

},

"merchant": {

"cardAcceptorIdCode": "123456",

"transactionReference": "Test Reference"

},

"transaction": {

"amount": "10000",

"currency": "NZD",

"dateTime": {{timestamp}},

"description": "Test"

},

"messageCategory": "PaymentAuthentication",

"threeDsRequestorInformation": {

"authenticationIndicator" : "paymentTransaction"

},

"threeDSSessionData": "c2773bec-5717-4564-816e-7897cfd6d7f3",

"notificationUrl": "https://api.csp.co.nz/threedsecure-notifications",

"browser": {

"accept": "text/html,application/xhtml+xml,application/xml;q=0.9,image/webp,*/*;q=0.8",

"javaEnabled": true,

"language": "en-nz",

"colorDepth": "32bits",

"screenHeight": 480,

"screenWidth": 640,

"timeZone": -780,

"userAgent": "Mozilla/5.0 (Windows NT 10.0; Win64; x64; rv:83.0) Gecko/20100101 Firefox/83.0",

"ipAddress": "2001:0db8:0000:0042:0000:8a2e:0370:7334"

}

}Headers

Content-Type: application/vnd.paymark_api+json;version=2.0Body

{

"protocolVersion": "2.1.0",

"authenticationSessionId": "88efbde4-41c5-4bda-91e1-dba569f51a4c",

"mpiTwo": {

"threeDSServerTransactionId": "98094f12-5ee4-4116-934f-f29a78240609",

"authenticationResponse": {

"transStatus": "Succeeded",

"authenticationValue": "U3VjY2Vzc2Z1bHkgYXV0aGVudGk=",

"authenticationStatus": "Y",

"eci": "05",

"acsUrl": "https://mpi-v2-simulation.test.v-psp.com/acs-simulation/challenge?redirectUrl=https://api.csp.co.nz/threedsecure-notifications",

"whitelist": {},

"cardholderInformation": "Message for the cardholder",

"authenticationResponse": "eyJhY3NDaGFsbGVuZ2VNYW5kYXRlZCI6Ik4iLCJhY3NPcGVyYXRvcklEIjoiQWNzT3BJZCAxMTExMTExMTExIiwiYWNzUmVmZXJlbmNlTnVtYmVyIjoiM0RTX0xPQV9BQ1NfUFBGVV8wMjAxMDBfMDAwMDkiLCJhY3NUcmFuc0lEIjoiQzM0Q0FCOEUtOEY0NS00ODI0LUE1RkQtMDI1M0M1RTdFRkZDIiwiYWNzVXJsIjoiaHR0cHM6Ly9tcGktdjItc2ltdWxhdGlvbi50ZXN0LnYtcHNwLmNvbS9hY3Mtc2ltdWxhdGlvbi9jaGFsbGVuZ2U_cmVkaXJlY3RVcmw9aHR0cHMlM0ElMkYlMkZoMW1tdjZlNng5LmV4ZWN1dGUtYXBpLmFwLXNvdXRoZWFzdC0yLmFtYXpvbmF3cy5jb20lMkZhZG1pbiUyRmh0dHBfc2xhY2tfZm9yd2FyZGVyIiwiYXV0aGVudGljYXRpb25UeXBlIjoiMDIiLCJhdXRoZW50aWNhdGlvblZhbHVlIjoiVTNWalkyVnpjMloxYkhrZ1lYVjBhR1Z1ZEdrPSIsImNhcmRob2xkZXJJbmZvIjoiTWVzc2FnZSBmb3IgdGhlIGNhcmRob2xkZXIiLCJkc1JlZmVyZW5jZU51bWJlciI6IkRTX0xPQV9ESVNfUFBGVV8wMjAxMDBfMDAwMTAiLCJkc1RyYW5zSUQiOiJmMjUwODRmMC01YjE2LTRjMGEtYWU1ZC1iMjQ4MDhhOTVlNGIiLCJlY2kiOiIwNSIsInRyYW5zU3RhdHVzIjoiWSIsInRyYW5zU3RhdHVzUmVhc29uIjoiMTYiLCJtZXNzYWdlVHlwZSI6IkFSZXMiLCJtZXNzYWdlVmVyc2lvbiI6IjIuMS4wIiwidGhyZWVEU1NlcnZlclRyYW5zSUQiOiI5ODA5NGYxMi01ZWU0LTQxMTYtOTM0Zi1mMjlhNzgyNDA2MDkifQ",

"transactionId": "ZjI1MDg0ZjAtNWIxNi00YzBhLWFlNWQtYjI0ODA4YTk1ZTRi",

"authenticationStatusReason": "16",

"authenticationReference": "C34CAB8E-8F45-4824-A5FD-0253C5E7EFFC"

}

}

}Headers

Authorization: Bearer uOABwqy14kv010MnLxI4dmb80xlR

Accept: application/vnd.paymark_api+json;version=2.0

Content-Type: application/vnd.paymark_api+json;version=2.0Body

{

"card": {

"cardNumber": "4000000000000002",

"expiryDate": "2021-07"

},

"merchant": {

"cardAcceptorIdCode": "123456",

"transactionReference": "Test Reference"

},